Looking ahead: 9 trends that will steer marketing in 2022

The first weeks of 2022 carried an unwelcome sense of deja vu. Major events were canceled, imperiling ad dollars. Overwhelmed hospitals and patchwork pandemic protocols cast a pall over the national mood. Amid the chaos, brand leaders were trying to lock in their agendas for a year that will put emerging technologies to the test while navigating talent shortages, supply chain disarray and the final hours for key identifiers.

Marketers must be cognizant that consumers are feeling as ground down as they are. Despite 2021's unfulfilled promises, including a reopening that never took shape, many brands will continue to pin their hopes on something better coming around the bend.

"Pandemic-weary consumers are looking for brands that relate to them within the current world we are living in. They have gone through an incredible couple years full of constant uncertainty and doing less of what they love," Matt Kleinschmit, founder and CEO of Reach3 Insights, said in an email. "Marketers who empathize with this condition while not pandering will build trust, and those that craft inclusive, inspiring and distinctive experiences will remind consumers of the world they aspire to have back."

Bumpy transitions will rock the industry in 2022. Social media heavyweights will reckon with the performance hit delivered by Apple's tracking changes, while digital marketers will wrestle with anxieties tied to the unknown cookieless future. Looking elsewhere for revenue, platforms will champion shopping capabilities that Accenture now estimates could create a $1.2 trillion social commerce market by 2025. These experiments will be marked by trial and error, as will continued gambles on tactics like nonfungible tokens (NFTs).

Below, Marketing Dive breaks down the nine trends that will stay top of mind for marketers even as other factors remain in flux. This piece can serve as a guide for what's setting the pace in marketing and media in the hectic months ahead.

Temperature check on the consumer

Nearing two years living under COVID-19, consumers are still mired in exhaustion and confusion. The roller coaster between hope and pandemic setbacks like the omicron variant has generated a weary sense of independence marketers should note as more people take risks in the chase for normalcy.

"Consumers are more likely to be open to change and will have shifting expectations, and they will also go into [this] year with a self-reliant mindset, knowing that they need to always be prepared for anything," Rachel Dalton, director of e-commerce and omnichannel insights at Kantar Consulting, said in an email.

Gone are the days of solely addressing pandemic realities, but building a message around practical solutions could resonate. A recent report from the Interactive Advertising Bureau (IAB) found four times as many consumers prefer efficiency in ads versus those who value campaigns that are "fun." In turn, brands that are able to emphasize tangible value may win out versus those that can't make a connection between their products and creative. Campaigns at the same time must be adaptive to swings in the public mood, including through a more diverse media playbook.

"Consumers are more likely to be open to change and will have shifting expectations, and they will also go into [this] year with a self-reliant mindset, knowing that they need to always be prepared for anything."

Rachel Dalton

Director of e-commerce and omnichannel insights, Kantar Consulting

"There's an expectation, and more importantly, an opportunity for brands to be able to respond in real time to consumers right now," said Mark Figliulo, founder and creative chairman of the agency Fig. "It's a little bit more utilitarian."

Reality crashes down on the metaverse

The metaverse became inescapable in 2021, with lofty promises and platform reinventions around wedding the real world with the virtual. In 2022, brand applications will be clunky, but could produce learnings for if and when the tech frontier realizes its potential.

Some companies, following Nike's lead, will make acquisitions that lean into existing strengths that easily translate to digital realms. More won't have their priorities in order during a messy land grab on a space few have a technological grasp on, let alone a distinctive pitch.

"Lots of brands will go into web3 to try and capture some value from a first mover advantage, but many of these experiences will miss the mark when it comes to the new value exchange of the metaverse," Mark Lainas, president of Canvas United, wrote over email.

Recent metaverse activations have seen paltry viewership, while economic components like NFTs are sparking thorny discussions around brand safety. Given that marketers are still grappling with the internet 2.0, the concept of an all-purpose virtual utopia remains just that — a concept, and one with substantial unanswered questions regarding governance.

"The more you think about it, the more it seems like we have a long way to go before we're out of the Wild West phase," said Andrew Frank, vice president analyst at Gartner. "There's a lot of future shock developments that feel like they're coming down the pike faster than we can think through all the implications."

The cookieless future is coming, but don't expect a magic bullet

With Google delaying the phaseout of third-party cookies to 2023, the coming months are expected to be crucial for the industry as advertisers, ad-tech providers and publishers implement new tactics that allow for tracking consumers and targeting ads. But even if Google sticks with its current timeline, the shape of a cookieless future is likely to crystallize gradually and incrementally.

"People only change when they're forced to," said Greg Sterling, vice president of market insight at location marketing platform Uberall. "They'll ride the cookie bus as long as they can, even as they test out these alternatives."

Many questions remain, including where the tech giant will come down on solutions like identity resolution and fingerprinting as workable solutions. Plus, advertisers and regulators will continue to work to satisfy consumers who demand both increased personalization but are wary of intrusive data-mining and targeting.

As players in the ecosystem seek to drive value for both brands and publishers, the result could be a mix of identity resolution, first-party data, contextual targeting and the use of data clean rooms — but not one perfect solution, according to Alicia Arnold, managing director at You & Mr Jones data company Fifty-five.

"There is a big sense of urgency: everybody wants to move forward and do something," she said. "As far as how quickly people are moving forward, that varies."

Consumer appetite drives wave of short-form video

Social media has captured consumer eyeballs for years, underpinning marketers' push to invest in platforms like Facebook, Twitter and Instagram. This year is no different, with social media ad spending forecast to reach $177 billion — blowing past TV — while digital channels overall are set to exceed 60% of global ad spend for the first time, per Zenith.

Although Facebook continues to dominate as the world's No. 1 social network with 2.9 billion monthly active users, marketers are shifting away from the big blue app to focus on buzzy short-form platforms like TikTok and Instagram Reels.

"TikTok will take Facebook's place as the proverbial social media punching bag as [it] struggles to scale and successfully moderate the unending surfeit of new content," said Matt Maher, founder of M7 Innovations.

"TikTok will take Facebook's place as the proverbial social media punching bag as [it] struggles to scale and successfully moderate the unending surfeit of new content."

Matt Maher

Founder, M7 Innovations

The explosion of TikTok, wider adoption of Reels and debut of YouTube Shorts marked 2021 as the year of short-form video and even shorter attention spans. Consumer appetite is pushing snappy, entertaining video as an increasingly core component of brands' social strategy. But the flood of fresh content on newer sites won't come without challenges.

"TikTok has become a potent, performative trend universe where creators all jockey to build as much 'algorithmic equity' they can to achieve the most eyeballs on their content," Maher said. "With the massive influx of new content from a digitally savvy and culture creating audience, TikTok will be unable to fully understand or handle content moderation at that scale and will continually play a reactive, losing game of cat and mouse with bad actors on the platform."

Small-time stars make inroads with brand deals

Like in the latter half of 2020, a convergence of pandemic-related effects shifted the role celebrities and influencers played in their 2021 brand partnerships. Influencer marketing continued to swell last year as brands tapped both big- and small-name stars, but microinfluencers are forecast to pull ahead and drive industry growth in 2022, Kantar and eMarketer predict.

As a top choice for brand collaboration due to their focused, yet small, audiences drumming up strong ROI, microinfluencers comprised 91% of engagement across all sponsored posts last year, Kantar found. That trend is set to continue into 2022 despite big name brands like McDonald's and Burger King drawing attention to celebrity-studded collaborations.

"The celebrity culture has expanded with influencer marketing, an industry that continues to evolve exponentially. This is of course different because the influencer owns the content creation of the ad," said Kantar's Global Knowledge Manager Polly Wyn Jones.

While Instagram remains the reigning platform for influencer marketing overall, TikTok is drawing the attention of lesser-known creators as brands explore how the buzzy social video app fits into their strategy. Look no further than Charli D'Amelio, who two years ago skyrocketed from typical TikTok creator posting choreographed dance videos to running a multimillion-dollar empire that includes media partnerships and brand deals with marketers like Dunkin' and Hollister.

"With the broadening definition of the word celebrity, we will see inspired and more unusual brand partnerships, like the recent two-way partnership where Billie Eilish launches her new music tracks within ads for the car maker Dodge," Jones said. "We are likely to see further franchise partnerships such as David Beckham fragrances, or even celebrities buying stakes in the brand they endorse such as Ryan Reynolds and Aviation Gin."

Creative campaigns will convey brands' soul-searching

With marketers preparing for a cookieless future, some are taking the opportunity to revisit the basics in both a tactical and creative sense. Brands from Gap and Target to Hulu in recent months have repositioned their marketing approach to focus more on brand value than pizzaz, deploying fresh creative campaigns conveying simple concepts like community and joy.

In an increasingly noisy landscape, one creative strategy is to forgo overpromising in advertisements and instead do some soul-searching to establish a marketing message that communicates a brand's core value.

"Being aggressively targeted won't give the best response. No one wants to feel like they're being sold to, even though realistically, we know we are," Michael Kalli, managing director at Ello Media, said in emailed comments.

The latest holiday season saw several marketers key into straightforward themes of togetherness in an attempt to authentically engage people around a time of year typically dogged by a focus on gifts and consumerism. Starbucks and Target put inclusion and community at the center of their efforts, suggesting how brands may continue emphasizing human-centric campaigns as 2022 marketing plans get underway.

"Customers want to see empathetic, human communication from brands, which slowly over time builds trust. A softer marketing approach that focuses on human centricity is the only way forward."

Michael Kalli

Managing director, Ello Media

"Customers want to see empathetic, human communication from brands, which slowly over time builds trust. A softer marketing approach that focuses on human centricity is the only way forward," Kalli said.

Investments in retail media, livestreaming could have different payoffs

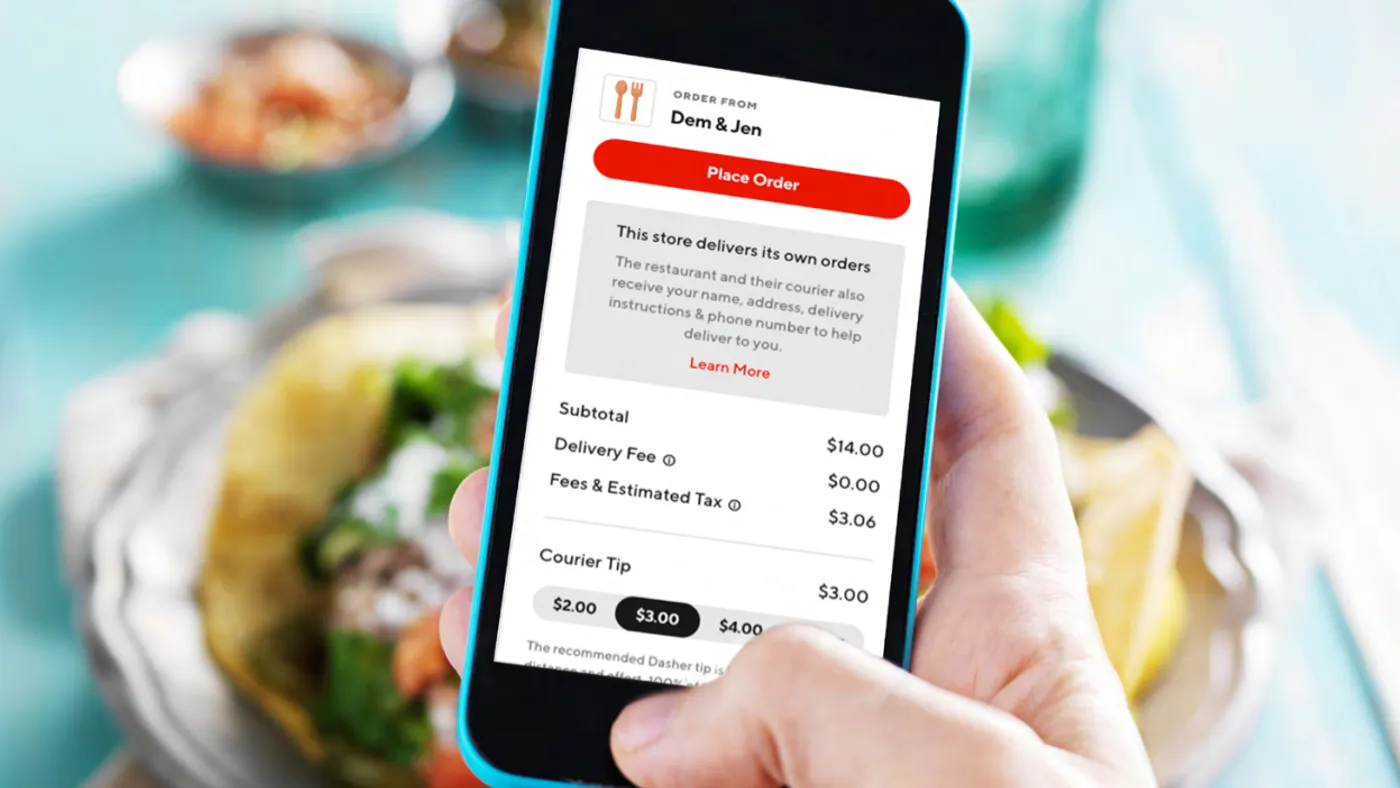

In 2022, marketers will continue to face a new ecosystem of brand development and brand choice, as brick-and-mortar sales decline and new brands and products emerge, according to Randall Rothenberg, executive chair of the IAB.

"These new brands are creating direct communication channels and great affinities for the next generation of shoppers," he said. "There are more marketing and communications techniques that are available that are far more favored by younger consumers."

A benefactor of this changing landscape could be livestream shopping. However, despite sunny forecasts and investments from major players like Walmart, livestreaming may not yield results for brands, per Phillip Jackson, chief commerce officer at customer experience agency Rightpoint.

"Brands communicating to a mass audience via a live shopping stream is not a thing that will happen in 2022," he said, noting that the associated cost and how platforms like Instagram compensate creators for livestreams is skewing perceptions of the format.

To perhaps drive more meaningful engagement, brands are expected to embrace retail media ads in 2022, but not all investments are created equal: 47% of big brands said they're partnering with retail media networks because they're required to due to retailer partnerships, with only 29% of DTCs having the same requirement, per the IAB 2022 Brand Disruption Report.

"The large national retailers have more leverage to demand retail media network investments from the large brands than they do over the small brands," IAB's Rothenberg said.

Brands will continue drinking from the fountain of youth culture

In 2021, brands tackled the growing imperative to get closer to culture in a variety of ways: CPGs reimagined their campaigns for younger audiences, while QSRs shook up executive and agency roles. At the end of the year, United Talent Agency acquired MediaLink, a strategic advisory firm whose focus includes marketing transformation, in a deal that demonstrates the shrinking divide between marketing and entertainment.

"We've built our advisory practice in the past five years based on this simple premise of brands going direct to the source," David Anderson, managing director of UTA Entertainment & Culture Marketing Division of MediaLink, said in emailed comments. "The rules of how brands show up are rapidly evolving and it represents a significant opportunity for marketers to develop a far deeper presence in both emerging and longstanding pillars of culture."

In 2022, brands and agencies could continue to look at culture as a source for leadership, integration and possible M&A opportunities as marketers seek to engage consumers — especially younger generations that are increasingly difficult to reach through traditional channels.

"We're going through a pretty significant demographic and technological shift that people have been talking about as an abstract for a long time," said Rob Holland, CEO of consumer research platform Feedback Loop. "We've seen it coming like a glacier… now it's moving into more of a tidal wave, where we're hitting a bunch of inflection points."

Agencies reckon with talent crisis

By most financial measures, 2021 was a good one for agencies. Holding companies rode a stunning ad market rebound to stronger results than they saw pre-pandemic. Players of all sizes benefitted from client demand in areas from e-commerce to brand transformation. But agencies, long notorious for burnout, are just as subject to the Great Resignation as any other sector — and maybe even more so.

"Talent is the biggest issue our industry is facing," Fig's Figliulo said. "It is forcing agencies to be more distinctive."

Attrition could be addressed in several ways. "Acqui-hiring" might become more common as the dealmaking market maintains its hot streak. Radically reimagining perks could also be necessary. Publicis Groupe is introducing a program that lets staff work from any region where the network has a footprint for up to six weeks.

Failing to promote such flexibility, including around geography, could affect recent hard-won account gains and a leg up on management consultancy disrupters that have more historical specialties in talent integration. It's easy for agency leadership to consider talent as a large numbers game, but the health of client ties sometimes rests on the individual.

"At the end of the day, something as relatively small in the grand scheme of things like an account director leaving can have a significant negative impact on that relationship," said Jay Wilson, vice president analyst at Gartner.