Apple is taking steps to boost its advertising business as the iPhone maker implements new privacy rules, updates that marketers have criticized for interfering with their ability to reach target audiences, according to several press reports.

The company will give marketers more data about ad performance on in-app ads bought through Apple instead of through third parties. The difference could give the company an advantage in drawing more advertisers to its platform if it decides to expand the business, The Wall Street Journal reported, citing ad executives familiar with the matter.

The plan also may help to fuel criticism that Apple will use recent changes to its app privacy rules to its benefit in ad sales. Apple last month introduced its App Tracking Transparency (ATT) feature in an update of software that runs devices including the iPhone. The feature asks customers to consent to share identifiers that help with ad targeting, but surveys have shown that many people won't opt into having their online activities tracked. Without behavorial targeting, marketers face the possibility of wasting their ad spending.

"The efficiency that has been built up over 15 years is literally back to the beginning," said Brian Bowman, chief executive of Consumer Acquisition, an agency that specializes in marketing apps on social media. "It is a fundamental change that will disrupt advertising creatively, and the impact will be felt substantially by small- and medium-size businesses." Bowman further detailed his criticism of Apple in a blog post.

Apple has defended the changes to its privacy rules multiple times amid the growing chorus of criticism. The company denied it was giving an advantage to its own products and claimed data restrictions on ads bought through third-party platforms were necessary to protect consumer privacy, according to a spokesperson cited by the Journal.

With Apple's latest ad offering, marketers who buy ads through third-party platforms to target consumers who have opted out of tracking will receive aggregate data about their campaigns after three days, the newspaper reported. Advertisers who buy ad space through Apple will see reports on results almost in real time, including more detailed information about how their ads performed, allowing those advertisers to adjust campaigns quickly.

'Moral high ground?'

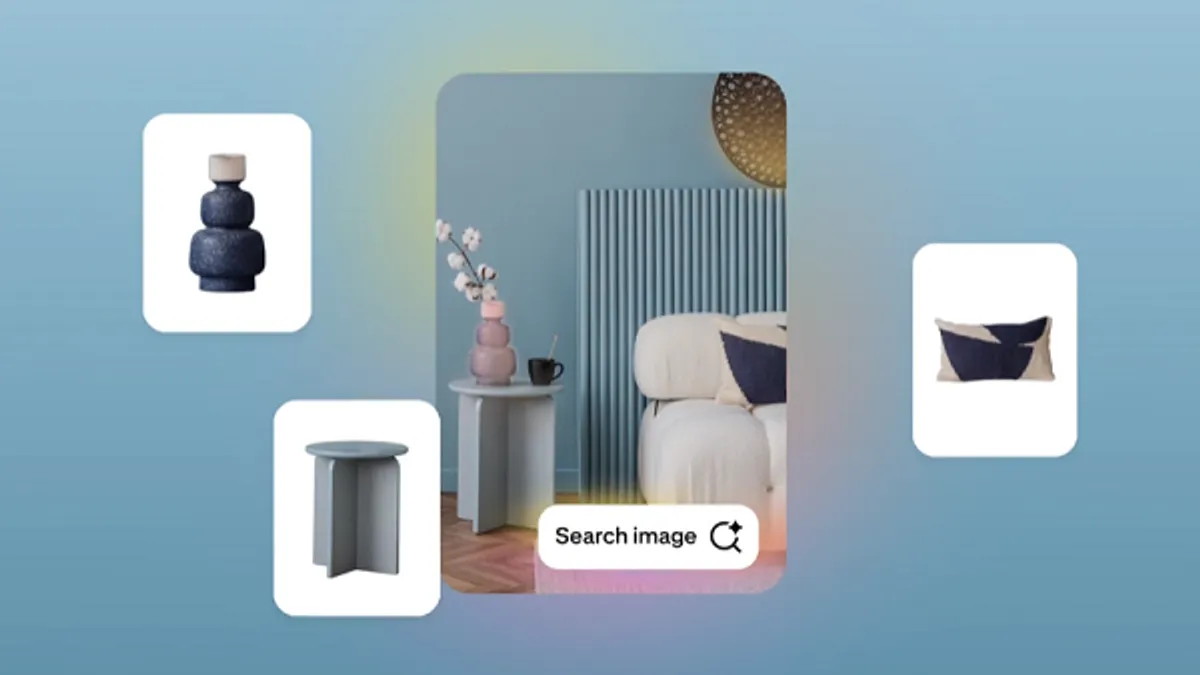

The tech giant currently sells search ads in the App Store that are geared for developers that seek to stand out among millions of apps, and display ads in its Apple News and Stocks apps for a wider range of marketers. Apple recently added an ad slot in the Suggested section of the App Store's search page. Dubbed "Search tab campaigns," the ads appear before people search for apps, and are part of the company's Search Ads Advanced service. Apple is using a CPM pricing model, with the cost based on bids from advertisers.

The ad format is unlike its other app ads that appear atop search results, and are a prominent place for conquesting campaigns. Those ads frequently show a rival sponsored brand before listing the actual search results. Because the App Store provides the only way for customers to download software for mobile devices like the iPhone and iPad, it's a highly visible part of Apple's media offering.

Consumer Acquisition's Bowman is skeptical of Apple's professed commitment to privacy as the company rolls out Suggested app ads. Because Apple can track people with their Apple IDs, the ads can be targeted based on user behavior.

"For some reason, Apple has been able to take the moral high ground here by calling privacy a human right," Bowman said. "Apple is deciding what the definition of privacy is but they're not offering real privacy."

"Apple is deciding what the definition of privacy is but they're not offering real privacy."

Brian Bowman

CEO, Consumer Acquisition

Apple's past efforts to expand into digital ad sales were mostly disappointing. Google in 2009 outbid Apple to acquire mobile advertising startup AdMob. The following year, Apple bought Quattro Wireless, an AdMob competitor, and started iAd to sell ads in iPhone apps. The digital ad market continued to grow quickly, but iAd didn't catch on with marketers, and Apple closed it in 2016. Two years later, the company again was said to pursue growth for its digital ad business, meeting with social media companies such as Snap and Pinterest about joining a network to place ads in apps and splitting the revenue.

Analyst estimates of the potential size of Apple's ad business have varied over the years, ranging from $2 billion this year to $11 billion by 2025 amid the expansion of its content offering. Apple's massive user base for its hardware and its fast-growing Services business is compelling for advertisers. Those services include the App Store and its own apps to distribute music, movies, TV shows, podcasts, games, magazines, newspapers and virtual workouts. If Apple can develop a way to make advertising more efficient within its privacy framework, it would be well positioned to grow its ad business even further.