The following is a guest post from Jonathan Chan, U.S. sales director of app marketing agency Nativex. Opinions are the authors' own.

If the pandemic has taught us anything, it's that mobile devices bring incredible value and peace of mind to consumers and brands. Sensor Tower reported that this year saw the most app downloads in the U.S. — more than 800 million monthly app downloads in April alone. This stresses how critical mobile is and where it stacks up in the overall advertising media mix.

However, the U.S. is entering its sixth month of quarantine. Couple that with all the habit changes people adopted, we're all relying on video chat platforms and trying to remain attentive to our mobile devices, as they are our gateway to safe socializing. And for some, mobile devices are the bedrock to a remote-work lifestyle. That said, it's safe to assume consumers are open to new experiences on mobile, and may now be receptive to advertiser engagement via new platforms, especially if that app or platform brings value to the user.

With that in mind, here are some things marketers should consider as they structure their ad budgets for the year's fourth quarter and into 2021.

Account for emerging mobile app usage trends

It's true, virtual communication experiences make shelter-at-home orders more bearable. However, for marketers, the downside is the steep competition for those platform's inventory. It makes sense, during the peak quarantine season that seven of the top 10 most downloaded apps leveraged video communication experiences across completely different user experiences. We group these in three buckets:

- Professional video conferencing: Given most working professionals could not have in-person connections, video conferencing services such as Zoom and Google Meet built virtual kinesthetic energy at scale. Said apps experienced 47.5 million and 15 million downloads, respectively, per Sensor Tower.

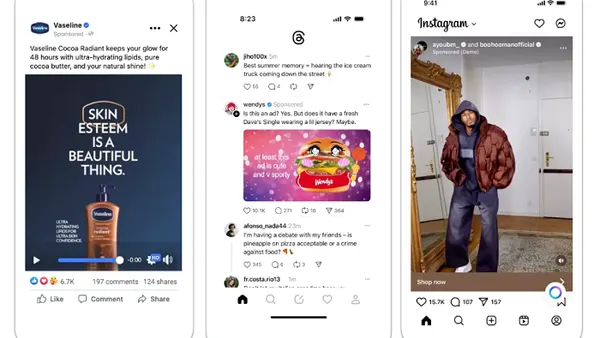

- Short-form social: On the personal side, mobile users had more time to upload short-form video on platforms such as TikTok, Instagram and Facebook. These platforms reported 3 million, 14.1 million and 13.4 million downloads.

- Personal video chats: Lastly, Facebook Messenger and Houseparty allowed for group video chats that embedded social elements such as gaming. Those channels saw 16.5 million and 12.5 million downloads, respectively.

At least 40% of new video conferencing and chat users intend to keep up with those platforms even after the pandemic subsides, according to eMarketer. Yet, this data does not necessarily mean video will continue to experience a stark rise, but is more likely to level off. With this in mind, buyers should adjust their efforts accordingly by optimizing their creative and planning for short and effective ad units. Additionally, with the leveling-off of new video-chat adoption, marketers must continue searching for unique ways to engage their desired audiences. Expanding into areas like health, wellness and audio applications could breathe fresh life into today's marketing efforts and help marketers hit campaign goals.

Adjust for health and wellness' role across mobile habits

While video platforms hold user attention and offer marketers strong engagement value, there will be a point where people consume new content and return to "normal" experiences through their devices. Health and wellness apps are a shining example here — eMarketer forecasts that health and fitness app usage in the U.S. will increase 27.2% this year, from 68.7 million in 2019 to 87.4 million in 2020. The report notes that telehealth services and health/fitness app usage during the pandemic could be a permanent habit change among consumers, with the research firm forecasting the number of health and fitness app users will stay above 84 million through 2022.

According to a recent report from Gallup, one in five U.S. adults use health apps or wearable trackers. This showcases a need for marketers to expand the breadth of their campaign efforts into new areas to maximize results — but doing so in areas that consumers are attracted to. These places are proving to be apps or services that fill a void the pandemic introduced. With this in mind, health and wellness publishers should improve products to match with the evolving media habits consumers have from a post-pandemic world. For example, implementing in-app messaging to promote offers such as post-workout subscription discounts to non-subscription users or tying app or brand rewards to increase retention.

Much of what has become normal in the U.S. can be heavily attached to the consumer media experience, and advertisers must stay abreast of the trends. As mobile apps and devices usage continue to rise, there is an opportunity to future-proof plans across a diverse range of mobile experiences.