Brief:

- Facebook Ads remained the top network for mobile apps during the second half of 2018, partially due to its performance in gaming, according to a new performance index by AppsFlyer, a provider of mobile attribution and marketing analytics. Google Ads had higher growth in non-gaming apps compared to Facebook, which likely reflect Google's "search intent" model, AppsFlyer said.

- AppLovin, Unity Ads, Apple Search Ads, Chartboost, AdColony, Vungle, ironSource and Liftoff rounded out the top 10 ad networks, according to AppFlyer's ranking. ROI metrics fluctuated greatly among ad platforms, with Snapchat jumping to fourth place from ninth in the non-gaming ranking, while falling from the top spot to No. 12 in casual games.

- Mobile fraud remained persistent at 30% worldwide as rates of app install fraud affected ad networks' rankings and threatened marketers' budgets and decision-making. Due to the growth of ad fraud, the second half of 2018 saw a 12% drop in affiliate-driven app installs, compared to a 32% lift in overall app installs.

Insight:

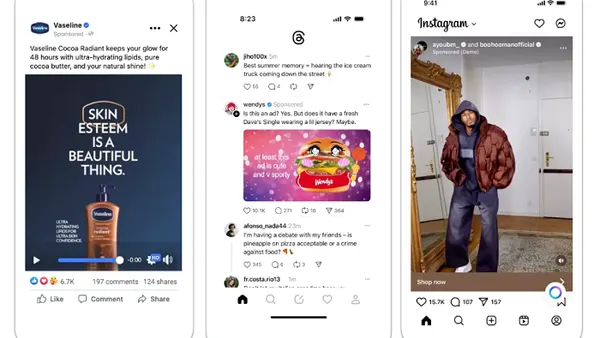

AppsFlyer's research indicates that Facebook and Google, the "duopoly" that dominates digital advertising, have maintained their strength in mobile app marketing. Apple Search Ads and Snap showed growth in app categories like shopping and ecommerce, but they still trailed Facebook Ads and Google Ads in the rankings, per AppsFlyer. Google Ads' share of app retargeting surged 190%, but Facebook Ads maintained its No. 1 spot among the ads that let mobile app marketers reach their customers while they use other apps or mobile websites.

Games are the third-most popular category of app after social media and shopping, according to a separate survey by researcher Newzoo, and remain a key opportunity for mobile marketers. Mobile gamers appear to be much more receptive to advertising, with 53% saying ads helped them get updates about products they want, compared to 42% of non-gamers. Almost half (43%) of gamers said they're more likely to buy or use brands that run ads they like, compared to 32% for non-gamers.

Among ads for gaming apps, AppLovin scored a No. 3 ranking behind Facebook Ads and Google Ads, making the mobile marketing platform a significant competitor for app install campaigns. IronSource almost doubled its market share to surpass Unity Ads with the fourth-biggest share of the market. Nevertheless, Unity Ads held its No. 4 position in the universal power ranking in the gaming category overall, ahead of IronSource at No. 5, per AppsFlyer.

Ad fraud remains a costly problem for app marketers, but perhaps the IAB Tech Lab's efforts this year to combat such activity will help to crack down on fraudsters. The final version of the group's app-ads.txt specification last week was made available for implementation among mobile ad platforms. The app-ads.txt file has the name and identification code for authorized sellers of the app's available ad inventory and helps to ensure that advertisers only bid on slots from authorized sellers.