Brief:

- Mobile shopping during the holidays jumped, with 64% of shoppers saying they placed online orders on a smartphone, per a survey by digital marketing firm Adlucent shared with Mobile Marketer. Mobile's role as a shopping research tool helped impressions for product listing ads (PLAs) to jump 113%, with mobile orders up by 152% and revenue up 239% from a year earlier.

- Mobile search revenues increased 25% across devices in 2018, with the portion of shoppers starting product searches on digital channels rising to 87% from 71% in 2017. The percentage of shoppers who used mobile devices in stores grew to 71% last year from 62% in 2017. Eighty-three percent of consumers ages 18 to 44 used a mobile device in stores, Adlucent found.

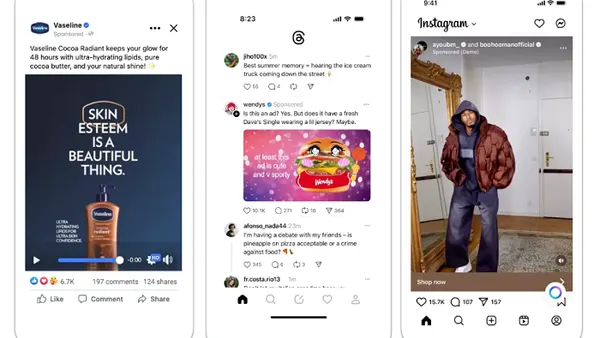

- Brands also boosted their spending on social media by 60% in 2018 from a year earlier and reaped the rewards with a 67% spike in revenue. Seventy-nine percent of surveyed consumers said they would rather learn about a product by watching a video rather than reading text on a web page.

Insight:

Adlucent's survey of holiday shoppers shows the growing importance of mobile advertising and commerce for brands during what's often a critical period for driving sales and foot traffic. Advertisers this year will need to boost their investments in mobile marketing and social media to reach consumers. Fifty percent of retailers said a mobile shopping app is a top priority for their omnichannel strategies, while 45% listed mobile points of sale as another key to their plans, Shopgate recently reported.

The popularity of mobile devices among shoppers increasingly means that retailers need to have a "brick and mobile" strategy that blends the physical and digital worlds. More than half (57%) of consumers said they have used a retailer's mobile app while in stores, often to redeem or find coupons or discover items on sale, per Yes Marketing. Shoppers are ready to try new technologies like augmented reality (AR), virtual reality (VR) and cashierless checkout that improve their in-store experience, but retailers are lagging in providing them, according to a recent survey by BRP Consulting.

Adlucent's research also confirms the stellar sales and profit growth for companies like Amazon, Facebook and Google parent Alphabet during the tail end of last year. Amazon's fledgling ad business surged by 95% in Q4 from a year earlier, outpacing Facebook's reported 30% gain and Google's 20% increase. E-commerce channel advertising saw a fivefold surge last year as marketers piled into Amazon Ads, a quarterly report by digital ad platform Kenshoo found.