Dive Brief:

- Xandr, the ad-tech unit owned by AT&T, announced that AMC Networks, Disney and WarnerMedia joined Xandr Invest, its platform for buying TV commercial time to reach custom audience segments. The arrangements give advertisers a way to reach 76% of U.S. households and 208.2 million viewers a month.

- AMC, Disney and WarnerMedia will make almost their entire national TV inventory available through Xandr Invest, which provides targeting based on AT&T's data for 170 million U.S. customers. Xandr Invest lets advertisers estimate unified reach among programmers before they buy and measure delivery and reach through unified metrics. Each network will sell its own ad inventory, while Xandr charges a fee for the transaction, according to AdExchanger.

- Xandr's announcement came the same day that CEO Brian Lesser resigned from the company. He had interviewed for the CEO job at WarnerMedia, which AT&T also owns, and was notified he wouldn't be selected, Reuters reported, citing an unnamed source.

Dive Insight:

Xandr's arrangement with AMC Networks, Disney and WarnerMedia means that advertisers can buy commercial time among multiple networks while targeting the same demographic groups. Media buyers can use Xandr Invest to access audiences through AMC Networks and Disney's portfolio that includes ABC, Freeform and FX.

The unit is a key part of AT&T's effort to create an advanced TV advertising business that emulates the way media buyers can target custom audience groups through digital ad platforms such as Facebook and Google. The sudden departure of Lesser, who's quoted in the announcement around the deal with AMC and Disney, suggests the unit is experiencing internal turmoil that could set back some of the momentum it's established in signing on key new partners.

"Xandr Invest provides powerful technology and unique consumer insights that enable advertisers to reach consumers in an engaging way," Lesser said in a press statement. "Working with marquee media brands like AMC Networks, Disney, and our sister company WarnerMedia, will help us create a unified, data-enabled solution for advertisers, which is the future of TV buying."

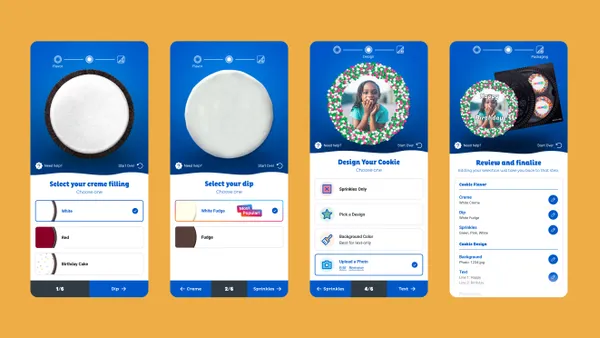

The unit aims to make audience targeting more uniform across TV networks, which has been difficult because networks define those audience groups differently. Advertisers can still buy TV commercial time directly from AMC Networks, WarnerMedia and Disney, while Xandr Invest's self-serve platform may help smaller advertisers and agencies gain access to targeted media buys on linear TV. Starting next month, advertisers can access private marketplaces for the three companies and create audience segments with their own first-party data and data from Xandr, Disney and AMC Networks, per AdExchanger.

Xandr's platform offerings currently include Invest, a demand-side platform that gives media buyers access to ad inventory, and Monetize, a supply-side platform (SSP) for publishers to sell ad placements. Xandr's Community is a digital marketplace to connect those buyers and sellers, per a separate announcement. AT&T last year also bought Clypd, a provider of data-driven ad targeting for TV networks, and integrated its SSP with Xandr, Ad Age reported.

The unit's biggest rival is OpenAP, a consortium that provides audience targeting and reporting for CBS, NBCUniversal, Fox, Viacom and Univision, Variety reported. WarnerMedia last year withdrew from OpenAP after AT&T completed its acquisition of Time Warner and continued to build up Xandr, which the telecom giant founded in 2018 to create a business that could better compete with companies like Facebook and Google. OpenAP last year introduced a centralized marketplace that lets marketers and agencies buy video ads across traditional TV and streaming video platforms.