Retail media is forecast to grow about 20% in 2025, according to eMarketer, as advertisers increasingly rely on the channel to tap into retailers’ store of first-party data and reach consumers closer to the point of sale. Walmart Connect continues to grow at a higher rate than the retail media market at large, notching 33% growth in the U.S. last quarter, outpacing the retailer’s overall sales growth by six-times and representing, along with membership fees, about a third of its operating income.

“Advertising has been one of the areas of our business that has changed the most, or better said, the impact or influence from that has changed our P&L the most,” said John David Rainey, Walmart’s executive vice president and CFO, at the Morgan Stanley Global Consumer & Retail Conference this month. “As we've gained share, advertisers, they want to follow the eyeballs. And so we've done really well in advertising.”

Walmart reaches 150 million customers a week between its website, app and stores, and can now reach 95% of the U.S. with same-day delivery — a competitive differentiator during holiday shopping and beyond. Meanwhile, its 4,600 stores unlock not just traditional consumer spending but an opportunity for on-site retail media. That scale, plus investment in measurement solutions and newfound connected TV prowess, is turning Walmart Connect into an advertising powerhouse.

“Walmart Connect has expanded from performance-based media to full-funnel solutions, focusing on new experiences across all customer touch points,” wrote Seth Dallaire, executive vice president and chief growth officer at Walmart U.S., in a recent LinkedIn post. “We've made significant strides in aligning and optimizing our advertising technology platforms, streamlining efficiency and expanding top-of-funnel opportunities for advertisers.”

Integrating Vizio

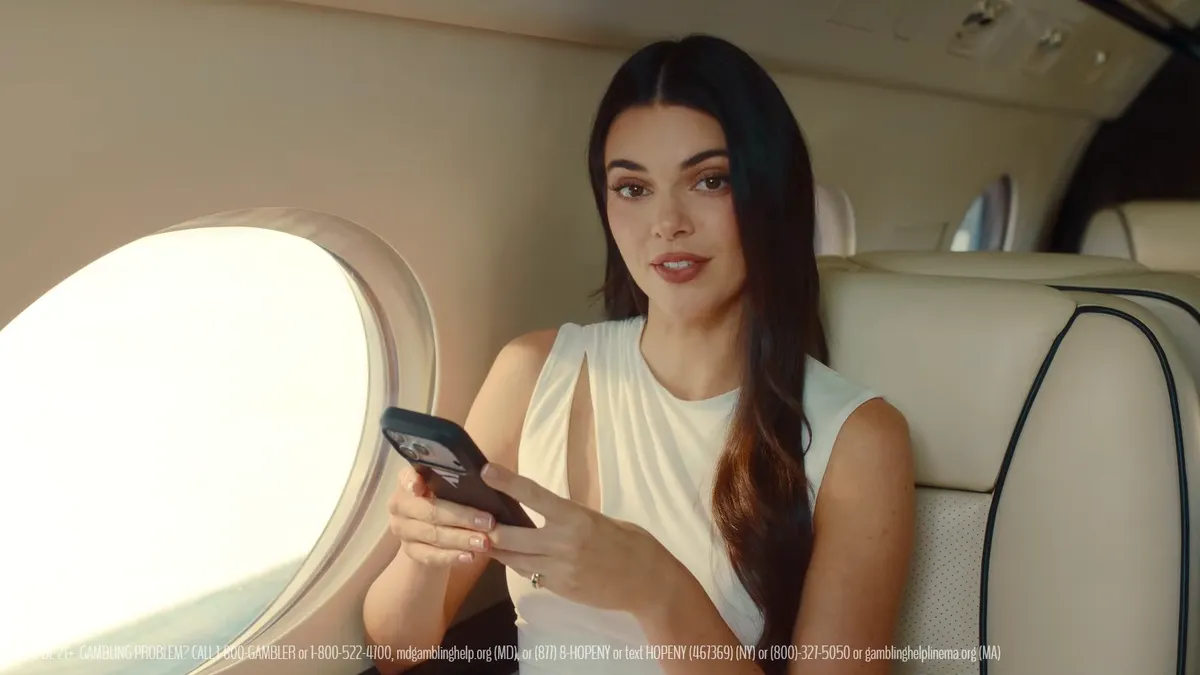

Now a year on from completing a deal for smart TV maker Vizio, Walmart is seeing returns on its investment: the company’s global ad business including Vizio surpassed 50% growth last quarter. The CTV opportunity has helped Walmart attract non-endemic advertisers across automotive, financial services and QSR industries — some of which have become the largest advertisers on the Walmart DSP.

“CTV as a whole is the fastest growing part of Walmart Connect, and Vizio is helping to fuel that,” said Ryan Mayward, senior vice president of sales at Walmart Connect, in an interview with Marketing Dive.

The Vizio integration began with giving advertisers the ability to address ads to Walmart customers based on shopping history and then measure the sales impact of showing ads on Vizio screens, including both its free, ad-supported streaming service and other ad-supported apps through its operating system.

Recently, Walmart opened advertising on the Vizio home screen, using Walmart audience data for targeting and measurement. The company is also offering a bundle that combines the Vizio home screen and Walmart’s app home screen, and will be looking to do more concurrent advertising across surfaces in the future. Next up, Walmart is rolling out Vizio’s operating system on the retailer’s private label Onn TVs, potentially expanding the Vizio OS footprint to 25% to 30% of U.S. households.

“One of the reasons we're so excited about Vizio is when customers see CTV ads, they are 28% more likely to buy products from from Walmart,” Mayward said. “The more customer touch points that a brand leverages, the more they will sell.”

Measurement across surfaces

Walmart has been investing heavily in bringing closed-loop measurement to all of its ad products, including search, display, video and in-app ads but also off-site products, social media and CTV ad purchased through the Walmart DSP. The retailer for the last year has offered an incremental return on ad spend metric for search, adding another dimension of incrementality beyond display and video.

“We're reporting on the volume of incremental sales and the efficiency of incremental sales, and the results have been great,” Mayward said. “When we talk about retail media trends, iROAS is what everybody wants for every retail media ad product, and that's where we're headed. Signals have been important, and then our solutions are getting more robust.”

The retailer now offers closed-loop measurement with TikTok, TV networks and Meta, the latter building on a previous relationship with the social giant to now measure ROAS. The company offers measurement several ways: some through its Walmart DSP, while other offerings are bespoke integrations, like one with Disney that rolled out last year.

“The thing that brands expect from us is consistent metrics across every advertising surface, whether in a Walmart store or outside of a Walmart store, and that's really what we're delivering to them,” Mayward said.

Walmart also continues to develop its capabilities around in-store retail media, a long-discussed extension of the channel that has failed to take off in the U.S. Along with investing in the hardware and adtech needed to activate in-store advertising, Walmart is working to introduce contextually relevant, customer-first ads and better measure brand lift and sales lift of ads across in-store screens.

“You're not going to see ads for power cords and screwdrivers on the bakery screen. We're going to show ads that are relevant to a food shopping experience,” Mayward said.

The AI playbook

While in-store might represent the next frontier in retail media, artificial intelligence continues to reshape the entire advertising landscape. Walmart Connect is expected to make announcements related to AI at the annual CES trade show in January, but has already applied AI to several parts of its adtech stack.

AI is integrated into its creative builder, where it can create image and video content quickly, cheaply and with high quality. The tech also powers a programmatic solution that has democratized advertiser access to display inventory in its app, and has improved bidding and optimization in the search experience. Similarly, AI technology is helping brands build their own shops in the Walmart app in just minutes.

Outside of advertising, Walmart is experimenting with AI through Sparky, its customer-facing generative AI assistant, and via a partnership with OpenAI that will bring shopping to ChatGPT. And while the rise of agentic commerce could change how consumers shop — and how advertisers spend on Walmart Connect — the retailer is embracing experimentation.

“The playbook for the next phase of of commerce, marketing, advertising, adtech and content creation — it's going to be written in real time,” Mayward said.