NBCUniversal today (March 20) continued its efforts to demonstrate how it plans to bring TV in line with digitally powered ad channels at One24, the latest edition of its annual technology and developer conference. Several announcements were made around advances in targeting, measurement, commerce and streaming experience as the media conglomerate prepares for its upfront presentation on May 13 and hosting the Summer Olympics.

Apart from those tentpoles, the gathering came as the streaming wars enter a new stage and battles over the future of measurement intensify. Meanwhile, NBCU has reshaped its leadership ranks after several prominent executives, including Linda Yaccarino and Kelly Abcarian, exited last year.

“We want the behavior with TV to look more like digital. We want to look more like performance media,” said John Lee, chief data officer for advertising and partnerships at the company, at a press briefing in advance of One24. “Think about how with a paid search, paid social or programmatic campaign, you’re optimizing up to the second — it’s one of the reasons to do it. You can course-correct while it’s still happening. I think that’s a pretty big behavior shift versus a set-it-and-forget-it, traditional mentality with TV.”

TV as performance media

Central to NBCUniversal’s proposition around performance is the combined power of its One Platform Total Audience (OPTA) media-planning and activation solution. First announced in January, OPTA allows advertisers to generate a media plan across linear and digital channels using more than 300 audience segments that connect consumers, content, emotional responses and outcomes. In a nod to buzzy technology that has captured the industry’s attention for the past year, the audience segments use a generative artificial intelligence engine that is trained on NBCU’s video library and web content.

In beta tests during Q1, OPTA helped advertisers better reach their desired audiences, with 48% more households in target compared to using demographic proxies, per data shared at the press briefing. In addition, impressions were 28% more efficient.

The companion to OPTA is the just-unveiled One Platform Total Measurement (OPTM) framework that delivers insights and outcome-based measurement across the entire funnel, from awareness to conversion. OPTM focuses on optimizing mid-funnel measurement around consideration metrics like search engagement and site traffic.

Toyota piloted the new audience and measurement capabilities, with NBCU building a lookalike model using a combination of the companies’ first-party data for the first time. The test saw a double-digit improvement in reach, saved double digits on the cost per reach and minimized duplication, with double-digit improvements across top- and middle-funnel norms, especially on Toyota’s chief concern, web conversion.

NBCU today announced that it is integrating its first-party identity spine with VideoAmp, stepping up a previous partnership to offer top-of-funnel measurement and allow for advertisers to transact around audiences for the first time. The company is also expanding its partnership with EDO around mid-funnel engagement metrics and bringing in Kochava for lower-funnel metrics including app installs, in-app purchases, website conversions and more.

Largely absent from the One24 conversation was iSpot.tv, which NBCU previously anointed as currency for national ad buys. Lee stated there has been a “narrowing” of focus after years spent canvassing and certifying Nielsen alternatives.

“It doesn’t mean that we won’t do business, obviously, with other providers,” Lee said. “But the ones that you’ll hear us working with in OPTM really represent our most strategic partners [with whom] we’re going to invest the most of our R&D into building custom data integrations into this framework. We can’t do that with dozens of providers.”

Stepping up content, commerce opportunities

NBCU has often launched new tech capabilities around major programming events, and this year’s One24 is no different. The company’s coverage of the Summer Olympics and Paralympic Games provides a wide-scale opportunity to offer new abilities for both advertisers and audiences.

For the first time, advertising during the Olympics and Paralympic Games will be available programmatically through a partnership with The Trade Desk that offers a private marketplace with biddable access. The move continues NBCU’s efforts to democratize access to TV advertisers and move beyond upfront commitments with major holding companies to a similar market of small- and medium-sized businesses served by companies like Meta and Google.

In the last year, NBCU has increased its number of advertisers by 40%, largely through expansions of programmatic buying. Along with bringing in new digital-first and direct-to-consumer advertisers, NBCU is seeing major advertisers adding programmatic elements for different types of performance-based campaigns.

The Olympics will also offer audiences new capabilities on Peacock as NBCU looks to beef up its streaming service before a period of heavy consumer use. Peacock Live Actions allow viewers to design their schedules with “choose your own adventure” type prompts, while Peacock Discovery Multiview is billed as an industry-first, four-view experience that could be clutch during the busy Olympics period.

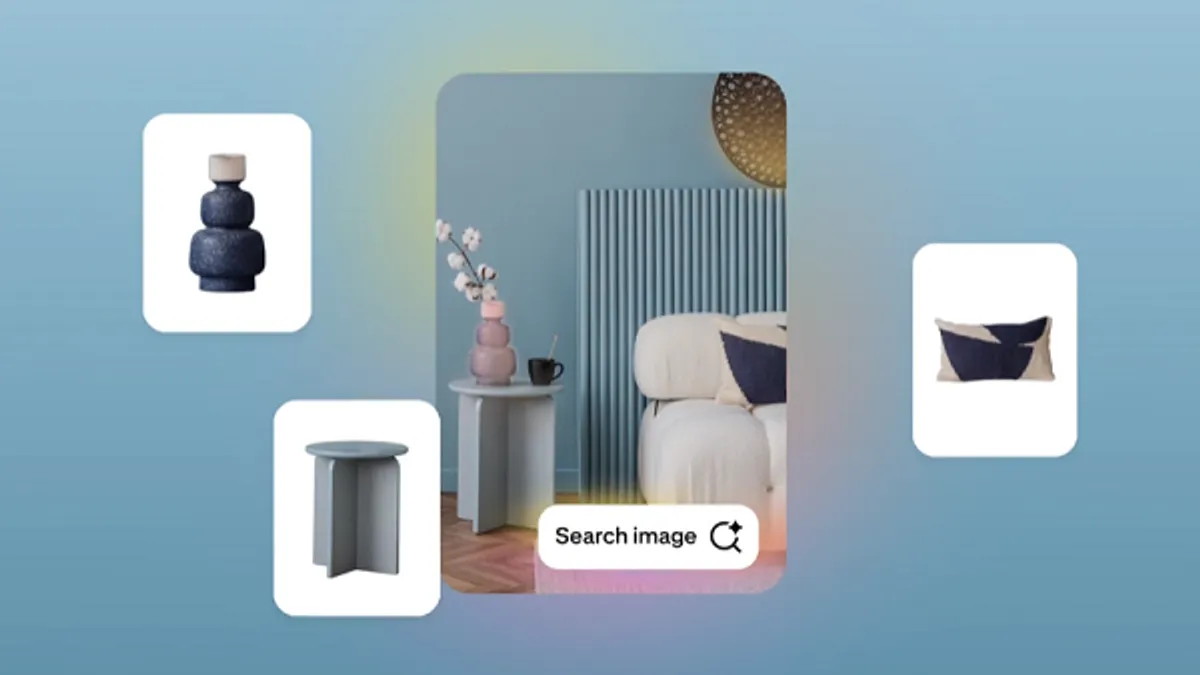

NBCU at the same time is adding new ways to engage with consumers who have their remotes and mobile devices in hand with new and expanded shoppable integrations. The company is expanding its AI-powered, Walmart-fulfilled Must ShopTV to six franchises and piloting a partnership with Comcast’s Xfinity X1 that lets consumers shop for the exact items they see in “Top Chef.” During the Olympics, NBCU will also roll out Virtual Concessions, a partnership with a to-be-determined last-mile delivery service that encourages viewers to purchase beverages and snacks in advance of sporting events and TV binges.

Streaming leads the way

The push to improve Peacock with content and commerce comes as more streaming platforms add ad-supported tiers and other media conglomerates step up their advertising-supported video-on-demand (AVOD) efforts, as competitor Fox has done with Tubi. But as Mark Marshall, NBCU’s chairman for global advertising and partnerships, said at the press briefing, AVOD is not easy and cannot be a “side hustle.”

“We obsess about advertising and having advertising at the core of Peacock every single day,” the executive said. “How do we make sure that it is a great ad experience for the consumer, because we know if it’s a great ad experience for the consumer, it’ll be a great ad experience for the marketer as well.”

NBCU’s work in streaming and connected TV follows the continued growth of those channels as a target of advertising dollars and audience attention. But it also comes as advertisers are grappling with signal loss and the deprecation of third-party cookies. With logged-in, authenticated users and a new integration with Google and LiveRamp (alongside a previous partnership with Trade Desk around UID 2.0), NBCU’s offerings are an “encapsulation of the power of TV today,” said Ryan McConville, executive vice president for advertising platforms and operations, during the press briefing.

“You can get great cultural IP, you can get automation, you can use data that’s actually future-proofed and not crumbling away like the cookie, you can do all that in an automated way for both big and small companies,” McConville said. “There’s not another streamer you can point to that offers those combinations of things and puts all those pieces together.”

“People think of the open internet and cookies for retargeting and performance, [but] when all that goes away, CTV or streaming may emerge as the best place to do performance advertising, because it will have an identity signal,” the executive continued. “You'll start to see not just TV be entering the performance space, but really start to lead it.”