Brief:

- Wendy’s plans to expand delivery coverage from its restaurants to about 80% of locations this year from 60% at the end of 2018. The burger chain partnered with food-delivery services DoorDash and SkipTheDishes to expand its delivery footprint, Todd Penegor, president and CEO of Wendy’s, told investors in a quarterly earnings call.

- Wendy's delivery saw average check sizes that were one-and-a-half- to two-times higher than a regular check, but didn't disclose what that means for the company's future sales. The company plans to spend an additional $25 million in digital platforms, and hired tech consulting firm Accenture to accelerate development, Penegor said.

- Wendy's uses its mobile app to help track active users, but Penegor declined to discuss those metrics. "We'll look at it based on external third-party competitive benchmarking to really understand where we stand," he said.

Insight:

Wendy’s management highlighted the importance of expanding its delivery footprint to drive sales to higher-value customers. Its same-restaurant sales growth weakened in North America to 0.9% last year from 2% in 2017, missing estimates. The company also forecast 2019 earnings that were lower than estimates amid its growing spending on digital scanners and data analysis to gain insights about customer behavior.

Wendy’s is among the major quick-service chains that are remodeling outlets, running new promotions or investing in online delivery to appeal to younger, tech-savvy customers. The chain recently partnered with DoorDash, offering its Baconator cheeseburger for free.

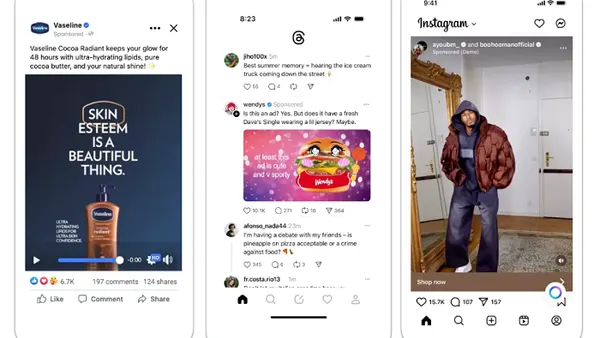

Along with its digital efforts, the company has developed a social media presence to take on bigger rivals like McDonald's and Burger King. Wendy's Twitter account has run witty viral campaigns that boosted its following by about 1 million last year and spurred a 113% jump in social media mentions, demonstrating how a solid social presence can increase engagement and brand awareness beyond more traditional marketing efforts. However, those efforts didn't translate into higher growth in same-store sales.

Digital restaurant orders grew 23% annually since 2013 and are expected to triple in volume by 2020, according to a report from The NPD Group. Six out of 10 digital orders are completed by mobile apps, while third-party restaurant apps such as DoorDash, Grubhub/Seamless and Uber Eats make up 40% of the 20 most-used apps.