Retailers for years have made a big deal about in-store retail media, with some going as far as to paint the category as having “broadcast-level” promise. Brands, too, acknowledge the value of reaching consumers when they’re already browsing in aisles to make a purchase, a tactic that has been plussed up by the advent of digital screens and other technology innovations.

However, a sticking point remains with in-store that separates it from traditional mass-reach levers and may dampen some of those TV-sized ambitions: It is difficult to buy, manage and measure like a media channel, creating barriers to investment and activation. These gaps result in confusion around who owns the in-store conversation and, ultimately, a lack of support for brands. EMarketer, which describes in-store as a “sleeping giant,” expects ad spending on the channel to surpass $1 billion by 2029, a sliver of the total retail media pie.

“Do I want to get in front of the shopper in store? Yes. Is there an infrastructure to support that properly yet? No,” said Benoit Vatere, chief media officer of canned water brand Liquid Death, on a panel at the Interactive Advertising Bureau’s Connected Commerce Summit last week.

Vatere cited Amazon as one of the few retail media networks excelling at in-store, as the e-commerce giant can leverage tech offerings like its demand-side platform to better track the path to purchase at Whole Foods.

“I’m sure Walmart is going to do similar things very soon and I hope all the other retailers are going to follow along,” said Vatere.

Failing to get in-store right carries risk for retail media networks that are looking to maximize the potential of assets they already own, including brick-and-mortar footprints, and as their onsite advertising reaches saturation. For brands, in-store can be appealing as a straightforward way to engage customers in a less noisy environment.

“I don’t think that [in-store] is a new vehicle, but I think it’s playing a massively more important role than ever before because consumers are so overwhelmed with the amount of messages that they're getting out of store,” said Chelsey Alexander, founder and CEO of Open Gate Consulting, during the IAB talk.

Lack of clarity

Other executives on the panel were in alignment that in-store is exciting but a difficult riddle to solve operationally. Much of the frustration with retail media has stemmed from marketers who view the channel as a tax imposed as part of larger trade agreements and existing in an ecosystem where results are hard to compare between platforms due to lack of standardization.

But at least on the in-store front, advertisers share some of the blame for creating complexity. Marketing organizations do not always clearly identify who is in charge of investment and many traditional CMOs can be allergic to areas like shopper marketing. A lack of clarity extends to the third-party marketing services ecosystem as well.

“We start calling [in-store] media and it triggers a bunch of really uncomfortable conversations about: Do I own it? Do you own it? Who does the creative? What agency is responsible ... who gets the billing?” said Jordan Witmer, managing director of retail media at Salt Media. “Somewhere, maybe fifth or sixth down that list is: Does it work?”

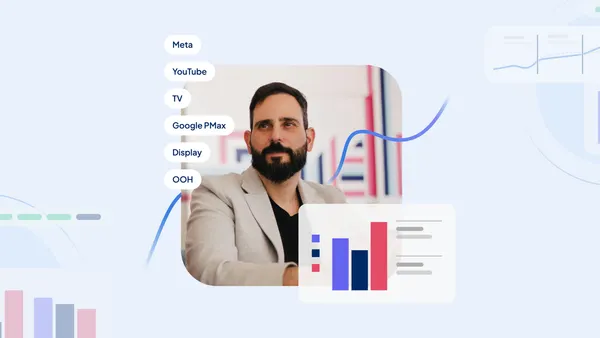

Some brands are making changes that recognize evolving needs around channels like retail media. CMOs are in some cases being swapped for chief growth officers while Liquid Death is an example of a CPG that has installed a chief media officer to better manage its strategy.

“You've seen a push from CMO to CGO. That is a reflection of this idea that your VP of media — that role sits in such an influential place in your organization,” said Witmer.

Chasing ‘attribution perfection’

A broader point of discussion at the Connected Commerce Summit was measurement. Marketers for years have pushed retailers to level-up their measurement sophistication and stop grading their own homework. Some speakers at the one-day confab described cracking the measurement code as more of an organizational problem than a technical one. For in-store, an obsession with measurement was viewed by panelists as a hindrance to unlocking growth.

“One of the things that I see as a barrier to full-funnel activation is this measurement conversation,” said Alexander. “We’re stuck in this standstill of [knowing] it's a huge opportunity — we know that there are millions of shoppers that are walking stores every single day, so it's obviously an upper-funnel opportunity — but we can't measure it, so we don’t do it.”

Measurement is another area where brands may need to work harder on ironing out internal alignment, at least when it comes to in-store efforts. Too many in the U.S. are also fixated on “attribution perfection,” according to Matt Claisse, media director at SMG.

Some may benefit from taking a page from the European model, where retail media networks have been built off of in-store first instead of digital due to the region’s limitations on the latter. Claisse pointed to marketers who immediately start asking if in-store campaigns drove outcomes like purchases as an example of how expectations in the U.S. do not often match reality.

“That is a crazy objective to have because you can’t even do that with digital. And we’re holding up this crazy standard that's just not gonna happen,” said Claisse.

To put the panelists’ advice in simpler terms: Don’t let perfect be the enemy of good.