The Black Friday and Cyber Monday cycle has expanded far beyond a single weekend. Retailers entered 2025 preparing for a longer, more fragmented season and the data shows that the shift is now permanent.

As the incentives engine powering some of the world’s best-loved retailers - from Sephora to Adidas - Talon.One offers a front-row seat to how customer behaviour is shifting in real time.

Using aggregated insights from roughly 300 global brands running incentives on Talon.One, several key trends stand out. The result is a practical benchmark for brands who want to measure their 2025 performance and set their 2026 strategy.

1. The promotional calendar began earlier than ever and retailers leaned into it

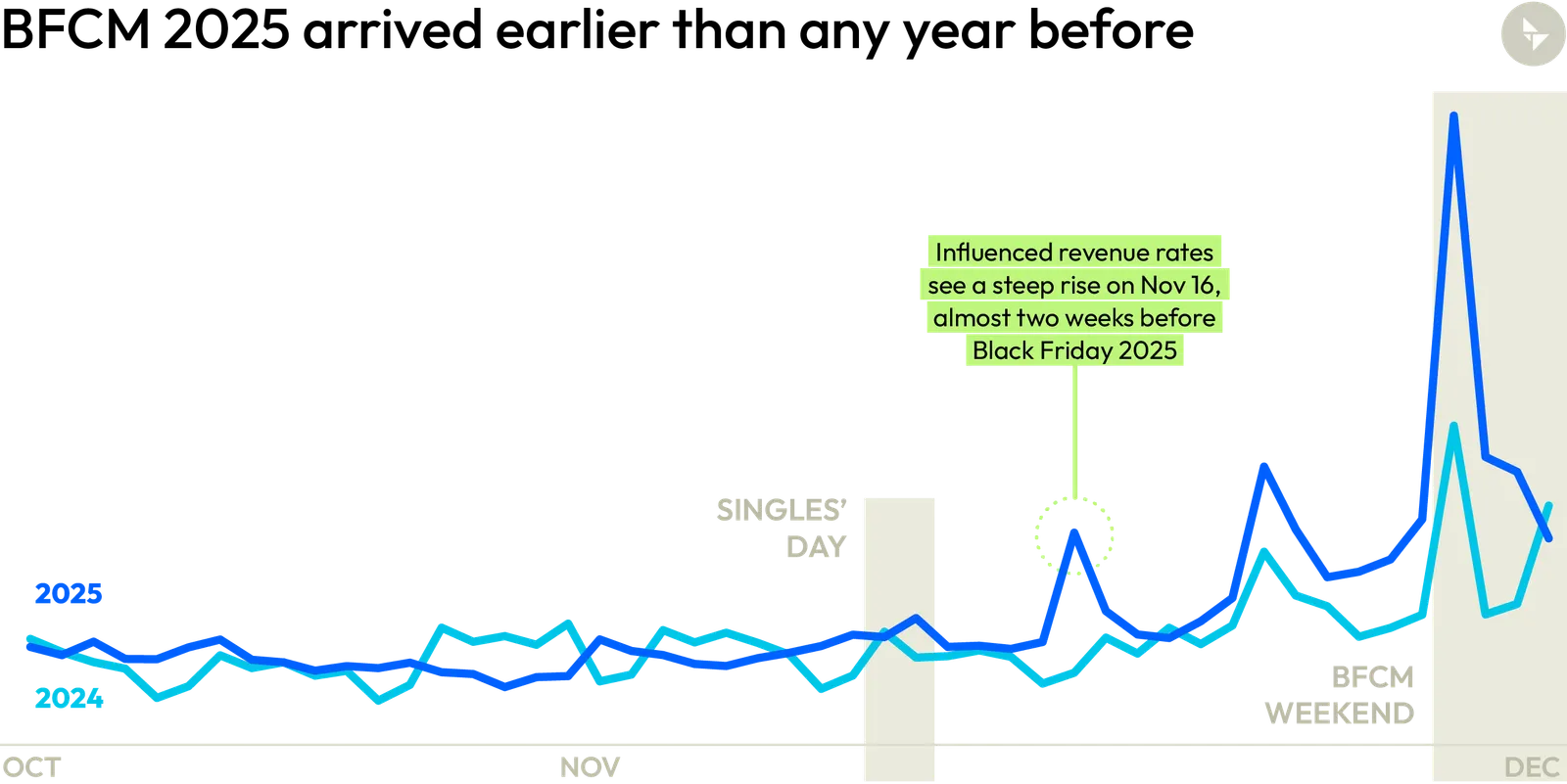

Timing was one of the most significant shifts observed in 2025. Influenced revenue - that is, any sale made with a personalized promotion or offer attached - began climbing on November 16, nearly two weeks ahead of the traditional peak. A growing number of retailers accelerated their start even further, kicking off offers in the first week of November to capture early intent.

Two types of events played a central role:

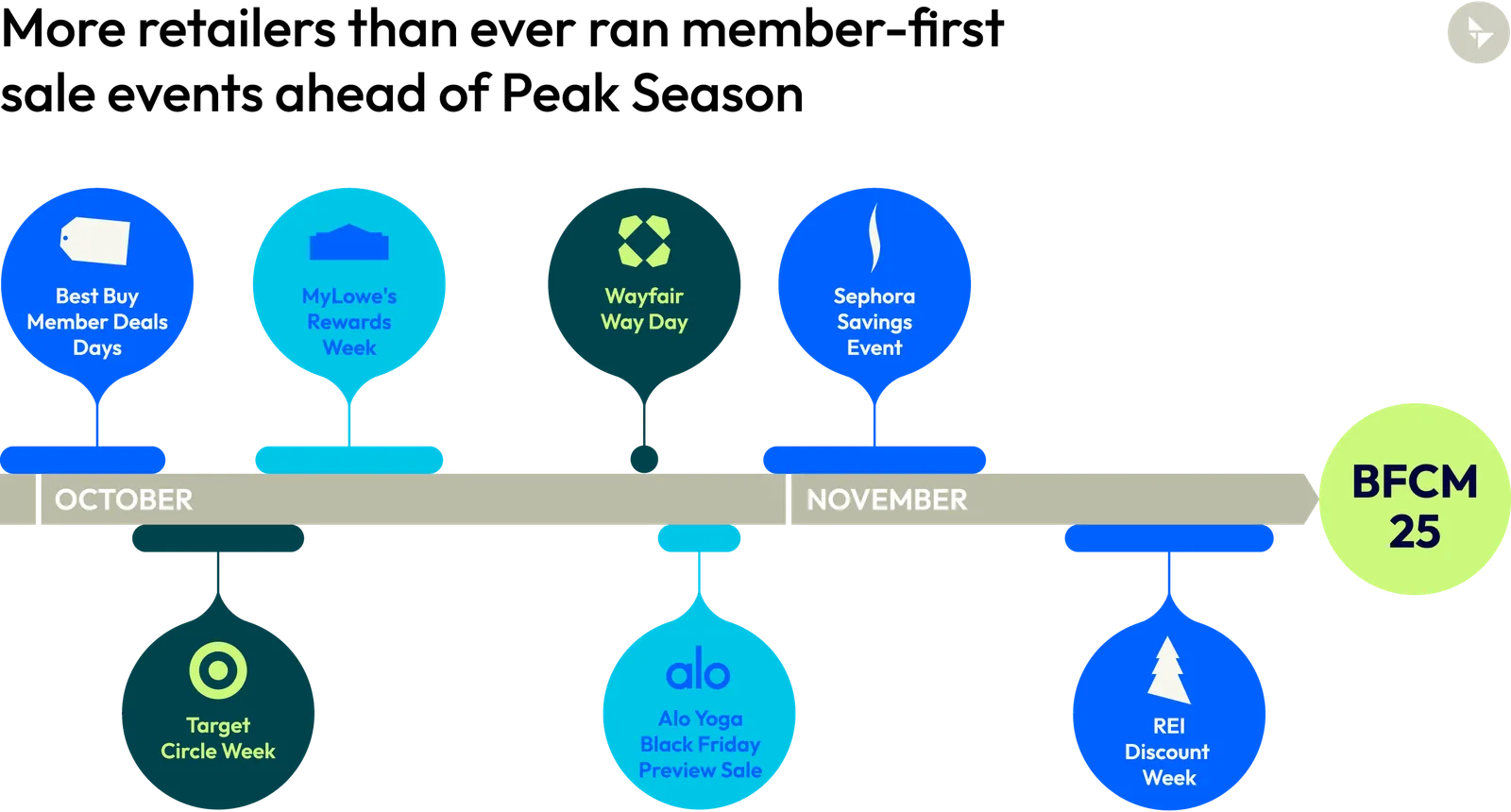

- Member Weeks: Brands expanded their use of loyalty-first activations throughout October and early November. These events were not treated as warm-ups but as meaningful value moments that drove spikes in demand. Early access pricing, gift-with-purchase mechanics, exclusive bundles and members-only inventory windows helped retailers build momentum early on.

- Singles’ Day: Once concentrated in APAC markets, Singles’ Day has now secured its place as a global holiday milestone. Talon.One’s data showed an 11% year-over-year lift in influenced revenue on November 11, driven by increased participation from U.S. and EMEA retailers.

With these trends in place, retailers are operating on a seasonal cadence rather than a holiday weekend model. Campaign planning must adapt accordingly, with channel, offer and loyalty sequencing mapped from September onward.

2. Retailers prevented the typical pre-BFCM slowdown

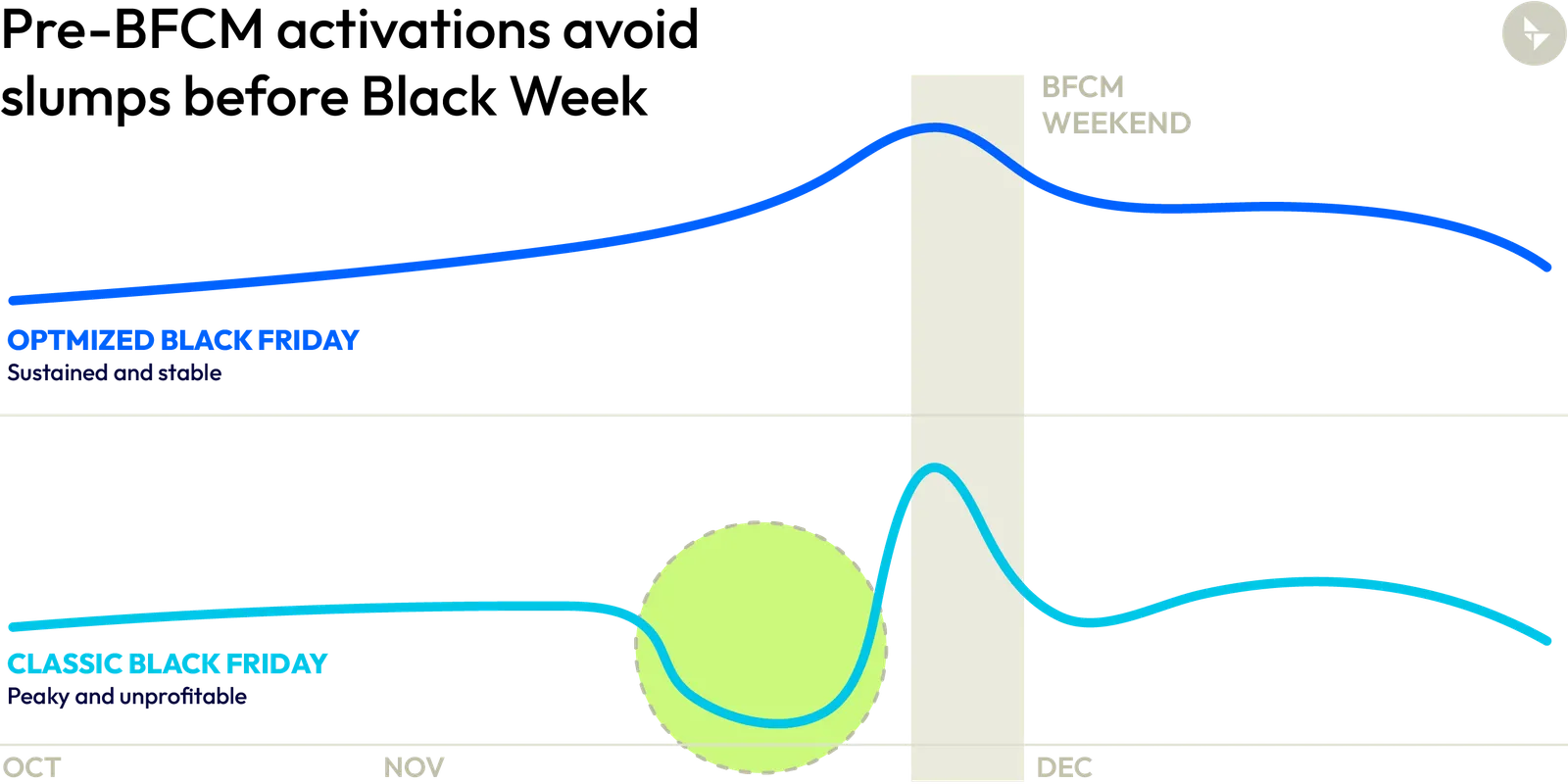

In previous years, conversion rates consistently dipped in early November as customers waited for Black Friday deals. The 2025 season showed that this pattern can be interrupted. Retailers who layered value moments throughout October and early November maintained steadier engagement and sales activity.

A combination of targeted early-access windows, mid-November nudges and loyalty program perks reduced hesitation and encouraged purchases ahead of peak week. The broader benefit of this approach is predictable demand. With less volatility leading into Black Friday, retailers can plan inventory, staffing and margin more effectively.

This structure also supports a healthier December. Because more customers entered loyalty ecosystems earlier in Q4, retailers are positioned to reactivate them through earned points, unlocked rewards and personalized follow-ups during the final holiday stretch.

3. Discounts increased, but in a measured way

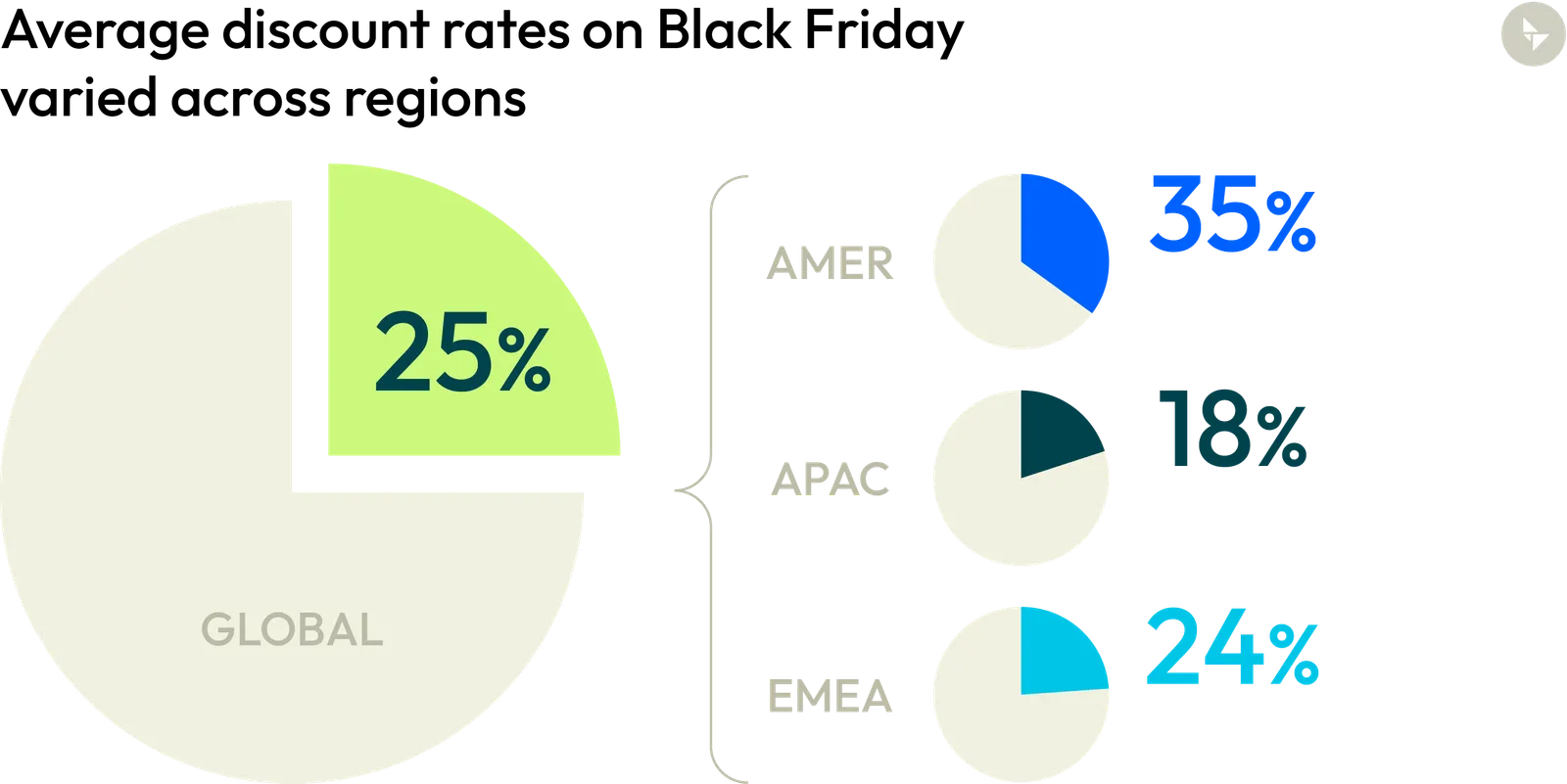

Value remained a top priority for shoppers and retailers responded with slightly higher discount rates across most regions. The average global discount rose from 21% in 2024 to 25% in 2025, with notable regional variations:

- EMEA: 24%

- AMER: 35%

- APAC: 18%

These increases were thoughtful and controlled. Rather than dramatically expanding markdown depth, retailers delivered more targeted value by combining moderate discounts with structured mechanics such as loyalty gating, tiering or spend thresholds. The data suggests a more mature approach: creating value through design, not only through price cutting.

4. Loyalty played a defining role across the entire season

Loyalty enrollment surged during Black Friday 2025. Across Talon.One retailers, daily new members on Black Friday grew 50% above the prior 30-day average and total enrollment doubled compared to the previous year.

Loyalty programs increasingly provide the framework for how value is delivered. Retailers positioned membership as the access point for early deals, higher-tier discounts, exclusive bundles and faster shipping.

The takeaway for 2026 is straightforward: loyalty strategy is effectively promotional strategy. The two can be fully intertwined under the incentives marketing umbrella.

5. Shoppers responded strongly to structured promotional mechanics

Standard item-level discounts remained the most widely used mechanics due to their clarity and ease of communication. However, 2025 saw expanded use of strategic formats that guided shoppers toward higher-value behaviors.

Key performers included:

- Tiered and minimum-order-value incentives aimed at lifting AOV

- Bundles and BOGO formats designed to drive volume

- Shipping incentives that reduced cart abandonment

These approaches helped retailers manage margin, increase purchase size and elevate engagement throughout the longer season. As shoppers grow more accustomed to early and varied value moments, structured mechanics will play an increasingly important role in holiday strategy.

How retailers can prepare for 2026

2025 demonstrated that holiday success now depends on how well retailers orchestrate a multi-event promotional season. Planning for October–December as a cohesive value journey - anchored in loyalty, informed by data and aligned with shopper behavior - will define performance in the year ahead.

Learn more about Talon.One and how to build a cohesive incentives marketing strategy that will set you up for success in 2026.