Dive Brief:

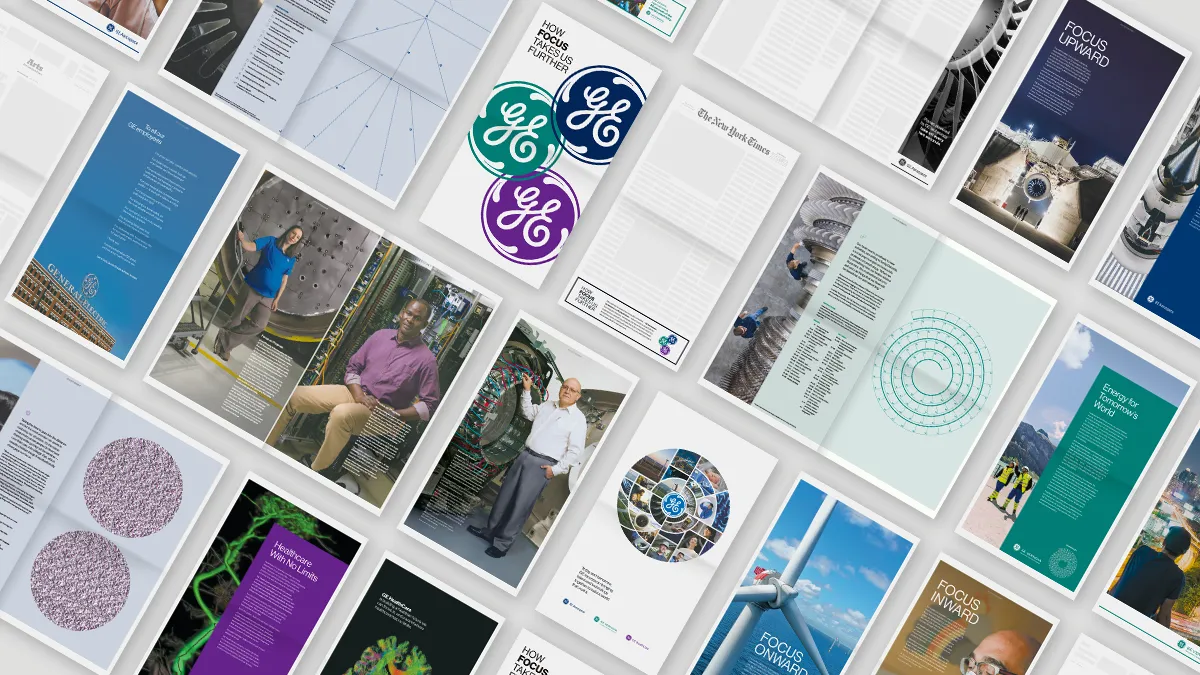

- GE took over the entire print edition of The New York Times on Tuesday, Dec. 6, the first single advertiser takeover in the paper’s 171-year history, according to information shared with Marketing Dive.

- GE promoted three newly created public companies — GE HealthCare, GE Vernova and GE Aerospace — via content developed with the publisher’s T Brand content studio. “Focus” is a common theme across an interactive experience that includes four “focus breaks.”

- The advertising campaign was developed with agency Giant Spoon and also features desktop and mobile activations, along with an audio takeover on “The Daily,” a podcast from the newspaper company.

Dive Insight:

Interactivity has become a marketing mainstay, especially online. Metaverse activations are intended to make it easier for consumers to interact with brands such as Wendy’s, Nike and Chipotle. However, GE’s interactive ad campaign is different. It’s not taking place on a cutting-edge piece of Web3 technology, but on newsprint. It's something consumers can actively touch and feel, providing a different experience.

“Today’s takeover of The New York Times print edition underscores our belief that focus is a superpower, especially in an age where our attention is divided among endless input, and that focus is the key to delivering long-term value,” said GE’s CMO Linda Boff in a press statement.

In order to spread public awareness about GE’s recent split into three companies, information is provided in four “focus breaks,” which build on a larger theme of staying focused. To emphasize the connection between taking breaks and the ability to focus and engage, engaging activities were part of the experience. They included a foldable paper airplane adapted by Ken Blackburn, a four-time world record holder for keeping a paper airplane flying; a Magic Eye optical illusion; and a circular crossword puzzle from Brendan Emmett Quigley, an award-winning puzzle maker.

Back in July, GE split into three separate, publicly traded companies. The move divided the massive conglomerate based on industry, creating a company for healthcare, one for energy and another for aerospace. The move came after a tumultuous year for the company, with stock falling approximately 30% by the July 18 announcement.