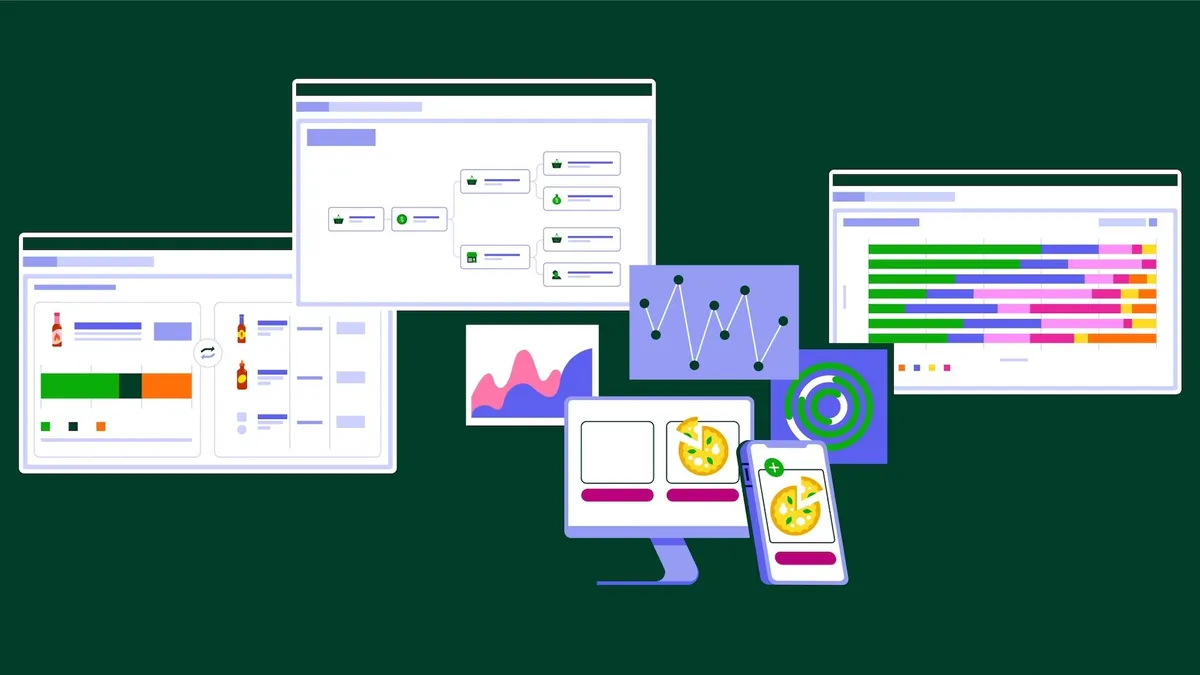

Artificial intelligence proved to be a widely used tool during the 2025 holiday season, with retail, travel, financial services and the tech and software industries experiencing triple-digit growth in AI referral traffic year over year in November and December. While the AI transformation could be observed across multiple industries, retail has felt an especially significant impact from the technology, with generative AI traffic growing 693% YoY, according to Adobe data.

“AI-driven traffic surged across industries,” said Vivek Pandya, director, Adobe Digital Insights in emailed remarks to Marketing Dive. “This means for marketers and retailers alike, we saw deeper engagement is translating directly into higher conversion during the 2025 holiday season.”

Adobe’s "Quarterly AI Traffic Report” analyzed more than one trillion visits to U.S. retail sites and over 100 million stock keeping units from Nov. 1 to Dec. 31. Additionally, a survey of over 1,000 consumers fielded in November 2025 gauged attitudes toward generative AI and how it is being used in shopping.

The AI funnel

AI has upended search traffic, forcing marketers to rethink their approach to search engines. While disruptive, AI-driven search has yielded remarkable results, according to the report. For example, AI referrals converted 31% more than non-AI sources over the 2025 holiday season. On Thanksgiving and Black Friday, AI referrals converted 54% and 38% more, respectively, than non-AI sources.

AI is also delivering high-quality traffic. AI-driven traffic on retail websites drew 14% higher engagement compared to non-AI sources during the holidays. Consumers referred through AI also spent 45% longer on websites compared to those from other channels. Additionally, AI-referred consumers viewed 13% more pages per visit than other sources, suggesting the technology attracts those who are research-oriented and engaged, per the report.

“Traffic from tools like ChatGPT, Gemini and Perplexity is growing rapidly,” Pandya said. “More importantly, it’s high-quality traffic that converts. For retailers and brands, this signals a lasting shift in how consumers discover and evaluate products. Generative AI’s role in commerce isn’t a passing trend. It’s becoming a core part of the digital shopping journey.”

AI-sourced traffic also drove 32% more revenue per visit than non-AI traffic, a considerable shift from the 2024 season where non-AI traffic was worth 51% more than AI traffic.

Demographic divide

As marketers look to leverage AI tools, it’s important to note that uptake of the technology is far from universal. While states such as Virginia, Washington, New York, California and Massachusetts are engaging with AI at twice the rate of the U.S. average, engagement in the South and Appalachia continues to lag.

It may be easy to conflate high rates of AI engagement with internet access, but this isn’t necessarily true, according to the report. Mississippi, for example, has a high rate of online activity but little AI engagement. Ultimately, AI adoption relies on exposure and awareness rather than access alone.

This divide could have significant implications for marketers looking to leverage AI tools. In leading states, just 2% of consumers have never heard of AI assistants. That number jumps to 7% when looking at lagging states. Similarly, 46% of consumers in leading states have used AI assistants for online shopping and 58% plan to do so this year. In lagging states, 39% of consumers have used the technology and 49% plan on using it this year.

Economic and geographical differences are both major driving factors when it comes to AI adoption. As of September 2025, high-income states account for 52% of all U.S. AI traffic, while low-income states account for just 20% of it. Consumers in urban areas also tend to be more aware of the technology, with 80% of urban-based consumers being aware of AI assistants compared to just two-thirds of consumers in rural areas. Forty-eight percent of urban consumers have used AI assistants for online shopping, per the report, while just 27% of rural consumers have. However, both groups plan on increasing their usage in 2026, 63% and 42%, respectively.

While adoption may take longer for some communities and demographics, the utility and potential of the technology points to continued growth, per Adobe.

“Marketers should continue to adapt as more consumers turn to large language models to research products, compare options, and make decisions,” said Pandya. “One thing is becoming clear: Generative AI is no longer a side channel for commerce discovery.”