Disney offices this week were perhaps one of the happiest places on earth. The media giant saw revenue increase 7% year over year to $23.6 billion in fiscal Q2, per an earnings report. Operating income from its direct-to-consumer segment jumped from $47 million in the year-ago period to $336 million.

That direct-to-consumer business, which includes streamers Disney+, Hulu and ESPN+, remains a priority and “core growth platform” for the company, CEO Bob Iger said on a call discussing the results with analysts.

“Not only is engagement up, but churn is down, and significantly. And as we look ahead, it’s obviously our desire and, in fact, we’re optimistic about being able to execute against it to turn the streaming business into a true growth business,” the executive said.

Iger on the call outlined a plan for streaming that revolves around improving user experience, investing in content and boosting technology. Disney continues to integrate its streaming services to deliver on the volume and variety of entertainment and sports that its portfolio entails, and is investing in local content outside of the U.S. On the technology side, Disney is increasing personalization and customization, with “a lot on the ad-tech side” coming soon, according to Iger.

“I was just taken through a roadmap for the rest of the year. So we’re not talking about many years. We’re talking about near-term where the technology improvements to the platforms will be significant,” Iger said.

Disney continues to see strong demand for its advertising offerings and now expects its advertising growth rate will exceed the 3% it predicted at the beginning of the year. Restaurants and healthcare sectors have considerable demand for advertising, although its DTC business faces some headwinds.

“The one place that obviously… continues to be a bit more challenged is on the DTC side, not driven by demand, but driven by supply as we have new entrants into that marketplace,” said Senior Executive Vice President and CFO Hugh Johnston.

A formula for success

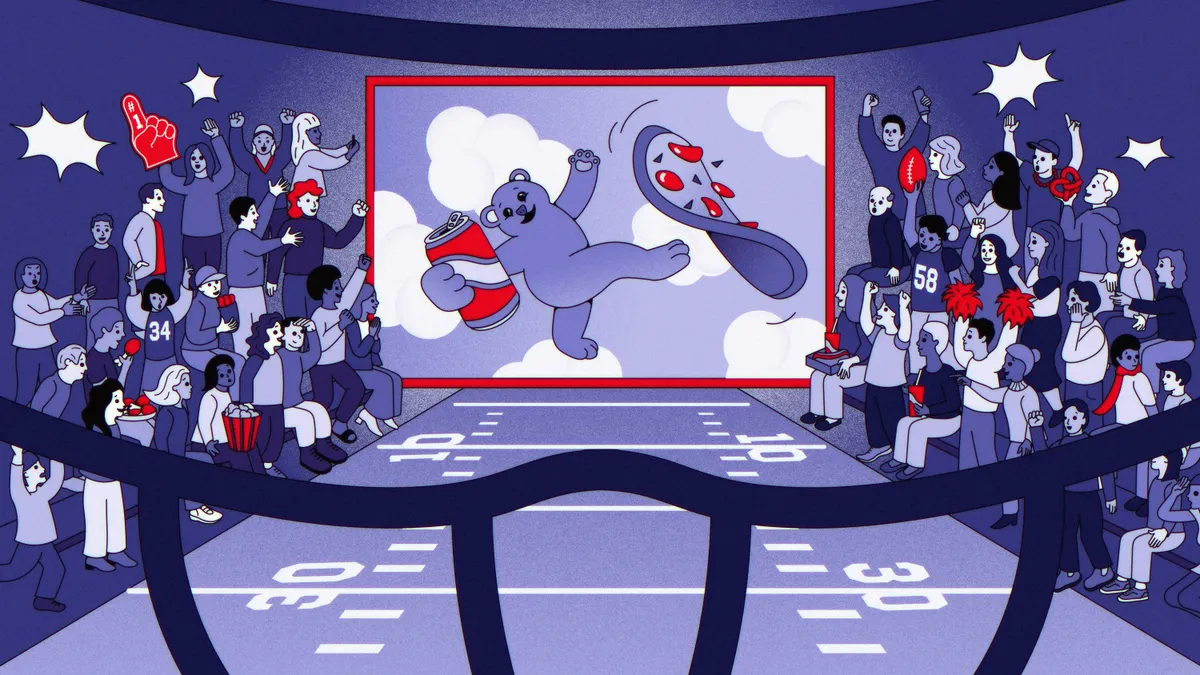

Disney’s earnings report gives the company momentum as it prepares for its upfront presentation, a glitzy pitch to brands and agencies for larger ad-spending commitments, on May 13. The company continues to develop new ways to integrate brands into its content to meet the evolving needs of marketers, said John Campbell, senior vice president for streaming, entertainment and multicultural solutions at Disney.

“How can [brands] start to not only be alongside culture, but push culture? How can we use our data-powered experiences at Disney to inform where they should show up? How can they also maximize their investments, especially in this economic climate? How can they make their dollars work harder?,” the executive said of CMO concerns in an interview ahead of the upfronts.

To those ends, Disney Advertising has developed a four-step formula for brands looking to maximize their integrations across the company’s portfolio. The strategy includes identifying brands that can add value for viewers; tapping into data to inform where they should show up; trusting and collaborating with writers’ rooms; and employing a “content everywhere” approach to guarantee multi-platform reach.

“When it works — when we hit all four — we see success,” Campbell said, noting that Disney does tens of thousands of integrations in any given year across both sports and entertainment specials, live, features and sponsorships.

Brands adding value

Streaming is a key part of the integrations, with seven in 10 Hulu and Disney+ viewers considering purchasing products featured in ad integrations, and 71% of viewers saying show integrations combined with supporting media make them more interested in a brand. Similarly, Disney has seen a sixfold increase in sponsorship revenue across its films on streaming platforms.

To capitalize on those figures, Disney has expanded and introduced offerings including Freshman Class, which integrates brands in new series from the start; Integrations Everywhere that look beyond 30-second ads for cultural connection; and Screen to Stream, which expands brand campaign life cycles to match those of a film release.

Upcoming Hulu shows from “Call Her Daddy” podcaster Alex Cooper (unscripted series “Overboard for Love”) and Mindy Kaling (comedy “Not Suitable for Work”) will receive the Freshman Class treatment after “star-power brands” sought to collaborate with Disney after their respective announcements. Poppi, the prebiotic soda brand recently purchased by PepsiCo, will be integrated with hit reality show “The Secret Lives of Mormon Wives” via in-show integrations, influencer collaborations and social posts.

Award-winning dramedy “The Bear” will return in early June for its fourth season. No stranger to brand integrations, the show will see returning sponsor American Express and new sponsor Vital Farms featured in custom content around the show.

Disney’s integrated approach reached its apotheosis in the recently concluded fourth season of “Abbott Elementary,” with the sitcom notching eight sponsors, including four in the technology category. Along with an in-show integration, Reckitt cleaning product Lysol was featured in custom content that marked the first time Disney Advertising tapped the show’s set and talent. The integration was so smooth that some viewers on social media were unsure if it was an ad or part of the show.

“It’s really fun to be at a 100-year-old company and still be able to be so entrepreneurial around our creative spirit,” Campbell said.