Brief:

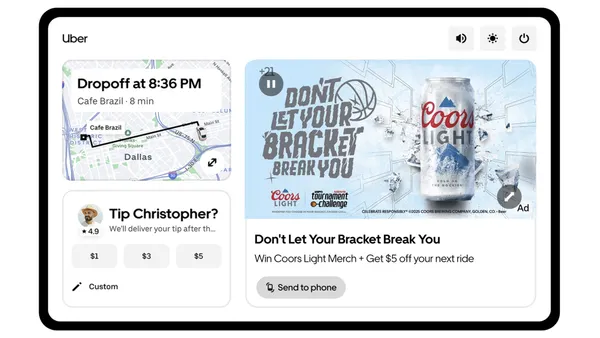

- Mobile usage will grow to 60% of back-to-school shoppers this year from 53% in 2018 as consumers rely on smartphones to look up prices, find deals and buy items from retailer websites and apps. Almost half (49%) of mobile shoppers said they'll use their devices to make a purchase, up from 46% last year, per an annual consumer survey by consulting firm Deloitte.

- The percentage of shoppers who use a personal computer for back-to-school will drop to 42% this year from 49% in 2018. Among that shrinking group of shoppers, the portion of people who said they'll make a purchase on the devices slipped to 50% this year from 53% in 2018, the survey found.

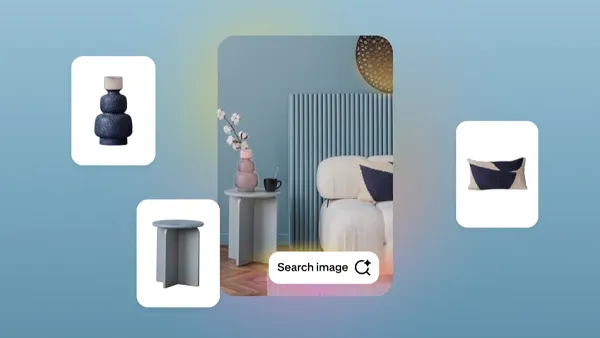

- Most consumers (85%) have no plans to use an emerging technology like voice assistants, social commerce, text-to-buy, virtual reality (VR), augmented reality (AR) or chatbot-based personal shopping during the back-to-school season. Mass merchants still dominate, with 88% of consumers saying they'll visit a store to shop, per the survey.

Insight:

Mobile marketers will grab a bigger share of the estimated $27.8 billion that shoppers are set to spend during back-to-school season, Deloitte's survey results show, as consumers expand their mobile shopping activities to include direct purchases. Brands and retailers must be prepared to reach those shoppers through mobile websites and apps as consumers hunt for the best deals on school supplies, clothing and electronics — especially considering how many shoppers use their smartphones to compare prices as they browse store aisles.

According to Deloitte, consumers are looking for deals, with 88% of shoppers saying price is the most important consideration when selecting a retailer — ahead of products (81%), convenience (80%) and brand or experience (38%). When it comes to price, consumers expect retailers to offer good deals, discounts, bundled items, clear ads, coupons and sales tax holidays.

Electronic gadgets, such as smartphones, tablets, wearables and their related cellular data plans, are the only product category whose growing online sales will have a negative effect on stores, which continue to dominate sales of school supplies and clothing. Half of consumers said they will buy electronics gadgets online, compared with only 37% in stores. Spending on electronics is forecast to grow by 29%, or $800 million, while the computers and hardware category will slump by 16%, or $600 million, this year from 2018, Deloitte estimates.

However, emerging technologies like voice shopping haven't gained much traction among the 29 million U.S. households that plan to buy school supplies this year, Deloitte's survey indicates. That finding supports other research that shows consumers are more likely to buy digital goods than physical products from a smart speaker like an Amazon Echo or Google Home. The number of U.S. consumers who shop by smart speaker will rise 31.6% to 31 million this year, researcher eMarketer said in a revised forecast this week. U.S. adults are about three times more likely to order digital movies, TV shows or music than groceries or electronic devices through the technology, per a Bizrate Insights study cited by eMarketer.

Total back-to-school spending is expected to rise only slightly as expenditures edge upward. There are regional differences for the first day of school, but shopping is expected to peak in late July and early August, making up 62% of all spending, per Deloitte.