Dive Brief:

- The pandemic has driven scores of people to start playing video games, with 28 million U.S. consumers picking up the hobby since March, according to the latest Facebook Gaming Marketing Report released today.

- Mobile gaming experienced 28% audience growth, and many newcomers are receptive to marketing messages. Thirty-five percent of surveyed "new gamers" in the U.S. prefer the ad-supported monetization model, Facebook said, and that figure jumps to 43% when polling existing U.S. gamers.

- Preference for free-to-play, ad-supported games was apparent across all markets Facebook researched, including the U.K., South Korea and Germany. As marketers chase consumers into gaming channels, keeping ad preferences in mind will be essential to ensure campaigns resonate and that the user experience is preserved.

Dive Insight:

Facebook's latest survey of the gaming landscape puts in perspective the massive influx of people who have gravitated toward the hobby since the pandemic's outset and how marketers might best engage them. Reasons for plugging in are fairly consistent across markets and match with other trends that have emerged as homebound consumers look to stay occupied. Over two-thirds (68%) of surveyed new gamers in the U.S. play to relieve stress, while 62% do so just to pass the time.

With tens of millions of new eyeballs glued to everything from big-budget console games to casual offerings, marketers are quickly following suit, shifting investments from traditional media into newer channels like streaming and mobile games. Facebook estimates there are now roughly 2.5 billion gamers globally, and that the crop of newcomers since March is both significantly younger than existing gamers and also carries a relatively even gender distribution — a noteworthy shift for a category that is historically male-dominated.

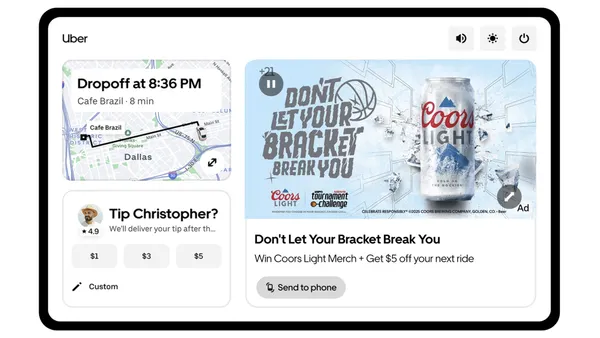

Those promoting their own mobile games should consider several factors when crafting their marketing messages. For instance, Facebook found 34% of new U.S. gamers and 46% of existing U.S. gamers are most likely to spend on ads that showcase gameplay. Familiarity with the game developer or intellectual property were also major drivers of purchase consideration. Facebook recommends mobile marketers look to the standard set by the console gaming industry to guide their storytelling strategies, as well as partnering with streamers to raise awareness. The report noted that 33% of existing U.S. gamers spend money to stop seeing ads, indicating that brand messages have the potential to grate on users over time.

Beyond the games themselves, channels for watching games continue to see meteoric growth. Facebook recorded 1 billion hours streamed for its Facebook Gaming service for the first time in 2020's third quarter, the report said, signaling the social giant's bets on the space are seeing traction. Those figures still pale in comparison to Amazon's Twitch, the market leader with 4.7 billion hours watched over the period from July to September. YouTube Gaming lands in the middle of the pack, recording 1.7 billion hours streamed in Q3 2020.

The launch of the first new gaming consoles from Microsoft's Xbox and Sony's PlayStation in seven years has added to the current gaming craze, a fervor on which marketers have tried to capitalize. KFC over the holidays released technical specifications for the KFConsole, a real gaming device that features a "chicken chamber" to keep food warm. Bud Light in November released the similar BL6, a gaming console shaped like a six-pack of beer that includes built-in koozies.

Fresh marketing efforts to reach gamers extend to more casual areas like mobile games as well. Kroger, the 137-year-old grocery giant, last year ran its first mobile gaming campaign with a display advertising push that executives said drove high conversion and engagement rates, while not sharing specific figures.