Dive Brief:

- Instacart, owned by Maplebear Inc., has launched Instacart Platform, which integrates a range of new digital services for grocers and retailers including fulfillment, insights and advertising options, according to information shared with Marketing Dive.

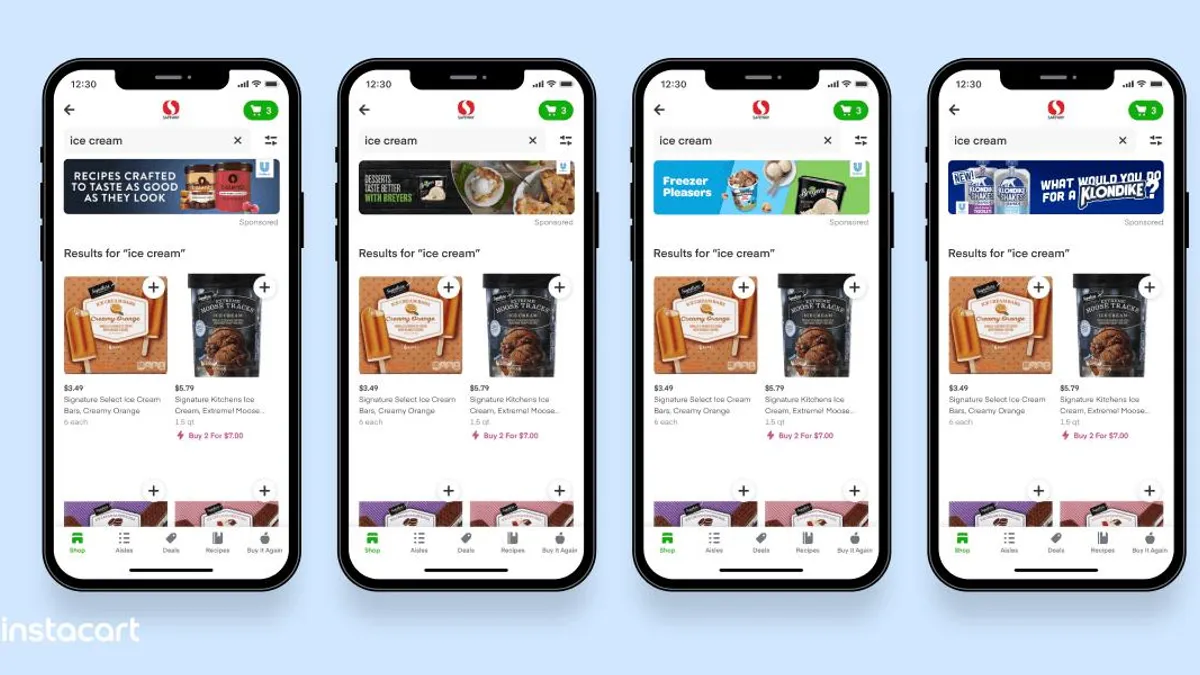

- The new Carrot Ads enables retailers to leverage Instacart's ad tech, ad products, engineering, sales and data insights to monetize their owned and operated e-commerce properties. It includes a revenue-sharing model and is currently being piloted with Schnuck Markets, Good Food Holdings, Plum Markets and other retailers with plans for a broader rollout later this year.

- Additional features include Carrot Warehouses, which will allow for 15-minute deliveries and Carrot Insights, which will help retailers understand buying trends. The launch of Instacart Platform gives power and tools to retailers as tensions between the grocery delivery service and its partners heighten.

Dive Insight:

Instacart is seen by many experts as a future competitor to retailers, especially as consumers continue to order groceries online, despite easing pandemic restrictions. A recent brand refresh put the delivery service's brand partners front and center. Instacart Platform seeks to further strengthen that relationship, and it arrives as a growing number of retailers are monetizing their owned e-commerce sites and apps with ad sales to CPG and other marketers who are looking for opportunities to reach consumers where they're shopping. Amazon's ad sales revenue recently topped $9.7 billion while Walmart continues to build its in-house platform for selling digital media. Instacart appears to be targeting mid-sized and smaller grocery retailers who may be looking to take advantage of this trend but don't have the resources to build the necessary capabilities themselves.

"We are committed to offering the best selection to our guests in a seamless online experience," Matt Jonna, CEO and co-founder of Plum Market, said in a statement. "The advertising capability within Instacart Platform enables a better experience for our guests to discover new products and ingredients on our app."

Through Carrot Ads, Carrot Warehouses and Carrot Insights, Instacart further integrates itself into the business of its retail partners, reflecting a strategy to expand the company's areas of business in the post-pandemic landscape and in advance of an expected initial public stock offering sometime this year. Each area can be leveraged individually by retailers, with Publix currently taking advantage of Carrot Warehouses and Key Food Stores Co-Operative onboard with Carrot Insights.

Instacart Platform is composed of five areas that are intended to both give retailers more control while further integrating Instacart into retailers' strategy. The first area is e-commerce, which creates custom-built digital storefront for Instacart partners. The next area is fulfillment, which allows for grocers to use online delivery as well as delivery from micro fulfillment centers, including via 15-minute delivery. Additionally, Instacart is rolling out enhanced insights and metrics.

Outside of the app, the delivery service has announced plans to enhance its brick-and-mortar presence as well. This comes in the form of new technology to streamline operations and scan-less carts, according to information shared with Marketing Dive. This could be an effort to decrease aisle clutter, which is a common complaint associated with the service.

Despite Instacart's apparent goal of further integration with retailers via Instacart Platform, some retailers have grown wary of partnering with the company because they don't want to share revenue or customer relationships. It's not clear if the promised benefits of making it easy for mid-sized and smaller grocery retailers to beef up their omnichannel capabilities via Instacart Platform will outweigh these concerns.